Question: Please show work . You have forecasted the returns for aQaQ (Nasdaq-100) and PWR stocks under different scenarios as below: Probability of the state of

Please show work

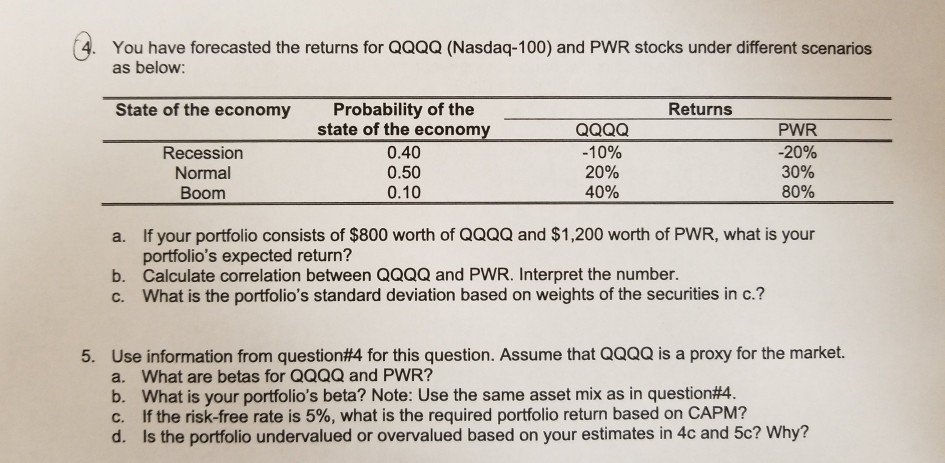

. You have forecasted the returns for aQaQ (Nasdaq-100) and PWR stocks under different scenarios as below: Probability of the state of the economy 0.40 0.50 0.10 State of the economy Returns Recession Normal Boom aQ0Q -10% 20% 40% PWR -20% 30% 80% If your portfolio consists of $800 worth of QQaQ and $1,200 worth of PWR, what is your portfolio's expected return? a. b. Calculate correlation between QQQQ and PWR. Interpret the number. c. What is the portfolio's standard deviation based on weights of the securities in c.? Use information from question#4 for this question. Assume that QQQQ is a proxy for the market. a. b. C. d. 5. What are betas for QQQQ and PWR? What is your portfolio's beta? Note: Use the same asset mix as in question#4. If the risk-free rate is 5%, what is the required portfolio return based on CAPM? Is the portfolio undervalued or overvalued based on your estimates in 4c and 5c? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts