Question: Please show work/calculations (esp if using excel) Your sisters Rebecca and Debra each just bought a house. Each sister paid $1,150,000 for the house. Each

Please show work/calculations (esp if using excel)

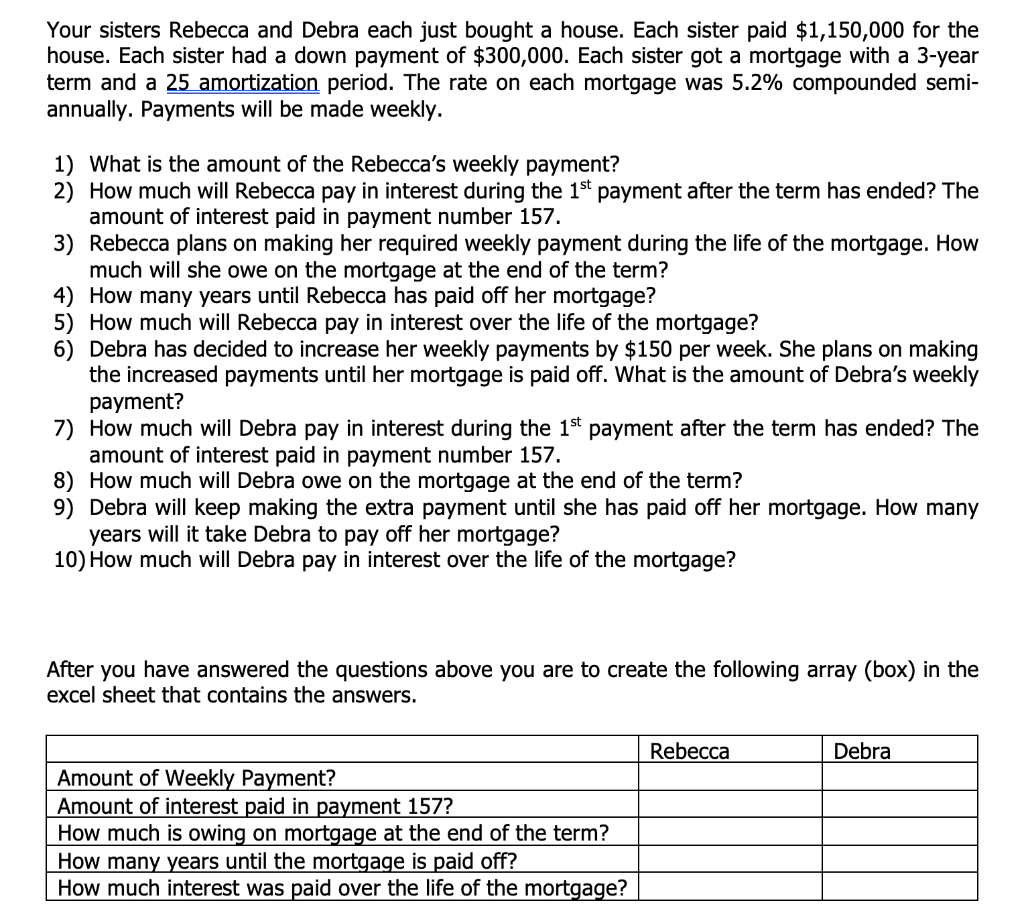

Your sisters Rebecca and Debra each just bought a house. Each sister paid $1,150,000 for the house. Each sister had a down payment of $300,000. Each sister got a mortgage with a 3-year term and a 25 amortization period. The rate on each mortgage was 5.2% compounded semiannually. Payments will be made weekly. 1) What is the amount of the Rebecca's weekly payment? 2) How much will Rebecca pay in interest during the 1st payment after the term has ended? The amount of interest paid in payment number 157. 3) Rebecca plans on making her required weekly payment during the life of the mortgage. How much will she owe on the mortgage at the end of the term? 4) How many years until Rebecca has paid off her mortgage? 5) How much will Rebecca pay in interest over the life of the mortgage? 6) Debra has decided to increase her weekly payments by $150 per week. She plans on making the increased payments until her mortgage is paid off. What is the amount of Debra's weekly payment? 7) How much will Debra pay in interest during the 1st payment after the term has ended? The amount of interest paid in payment number 157. 8) How much will Debra owe on the mortgage at the end of the term? 9) Debra will keep making the extra payment until she has paid off her mortgage. How many years will it take Debra to pay off her mortgage? 10) How much will Debra pay in interest over the life of the mortgage? After you have answered the questions above you are to create the following array (box) in the excel sheet that contains the answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts