Question: please show working (d) Suppose a project initially costs 900 million and generates cash flows of 350 million per year for three consecutive years. Cash

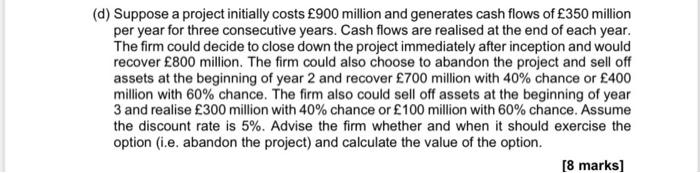

(d) Suppose a project initially costs 900 million and generates cash flows of 350 million per year for three consecutive years. Cash flows are realised at the end of each year. The firm could decide to close down the project immediately after inception and would recover 800 million. The firm could also choose to abandon the project and sell off assets at the beginning of year 2 and recover 700 million with 40% chance or 400 million with 60% chance. The firm also could sell off assets at the beginning of year 3 and realise 300 million with 40% chance or 100 million with 60% chance. Assume the discount rate is 5%. Advise the firm whether and when it should exercise the option (i.e. abandon the project) and calculate the value of the option. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts