Question: please show working out AB Ltd operates retail stores throughout the country. The business is divisionalised. Included in its business are Divisions A and B.

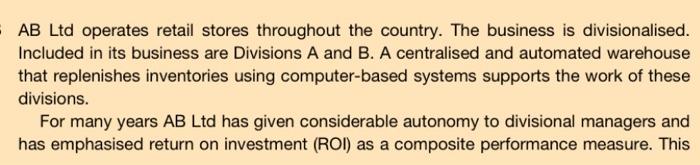

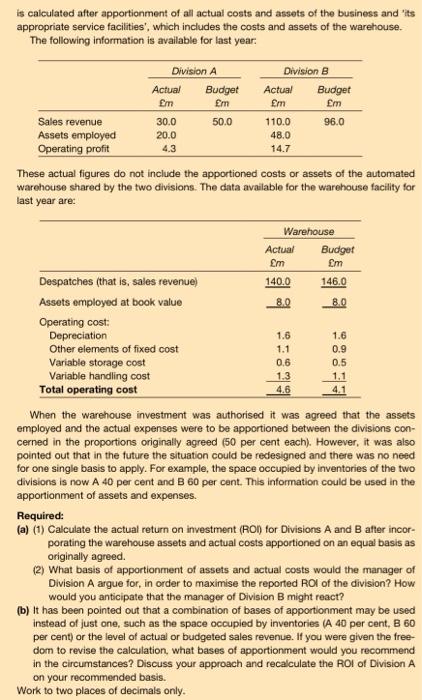

AB Ltd operates retail stores throughout the country. The business is divisionalised. Included in its business are Divisions A and B. A centralised and automated warehouse that replenishes inventories using computer-based systems supports the work of these divisions. For many years AB Ltd has given considerable autonomy to divisional managers and has emphasised return on investment (ROI) as a composite performance measure. This is calculated after apportionment of all actual costs and assets of the business and its appropriate service facilities', which includes the costs and assets of the warehouse The following information is available for last year: Division A Division B Actual Budget Actual Budget Em Em Em Em Sales revenue 30.0 50.0 110.0 96.0 Assets employed 20.0 48.0 Operating profit 4.3 14.7 These actual figures do not include the apportioned costs or assets of the automated warehouse shared by the two divisions. The data available for the warehouse facility for last year are: 140.0 146.0 1.6 1.1 1.6 0.9 Warehouse Actual Budget m Cm Despatches (that is, sales revenue Assets employed at book value 8.2 8.0 Operating cost: Depreciation Other elements of fixed cost Variable storage cost 0.6 0.5 Variable handling cost 1.3 1.1 Total operating cost 4.6 4.1 When the warehouse investment was authorised it was agreed that the assets employed and the actual expenses were to be apportioned between the divisions con- cerned in the proportions originally agreed (50 per cent each). However, it was also pointed out that in the future the situation could be redesigned and there was no need for one single basis to apply. For example, the space occupied by inventories of the two divisions is now A 40 per cent and B 60 per cent. This information could be used in the apportionment of assets and expenses. Required: (a) (1) Calculate the actual return on investment (RON for Divisions A and B after incor- porating the warehouse assets and actual costs apportioned on an equal basis as originally agreed (2) What basis of apportionment of assets and actual costs would the manager of Division A argue for, in order to maximise the reported ROI of the division? How would you anticipate that the manager of Division B might react? (b) It has been pointed out that a combination of bases of apportionment may be used instead of just one, such as the space occupied by inventories (A 40 per cent, B 60 per cent) or the level of actual or budgeted sales revenue. If you were given the free dom to revise the calculation, what bases of apportionment would you recommend in the circumstances? Discuss your approach and recalculate the ROI of Division A on your recommended basis. Work to two places of decimals only. AB Ltd operates retail stores throughout the country. The business is divisionalised. Included in its business are Divisions A and B. A centralised and automated warehouse that replenishes inventories using computer-based systems supports the work of these divisions. For many years AB Ltd has given considerable autonomy to divisional managers and has emphasised return on investment (ROI) as a composite performance measure. This is calculated after apportionment of all actual costs and assets of the business and its appropriate service facilities', which includes the costs and assets of the warehouse The following information is available for last year: Division A Division B Actual Budget Actual Budget Em Em Em Em Sales revenue 30.0 50.0 110.0 96.0 Assets employed 20.0 48.0 Operating profit 4.3 14.7 These actual figures do not include the apportioned costs or assets of the automated warehouse shared by the two divisions. The data available for the warehouse facility for last year are: 140.0 146.0 1.6 1.1 1.6 0.9 Warehouse Actual Budget m Cm Despatches (that is, sales revenue Assets employed at book value 8.2 8.0 Operating cost: Depreciation Other elements of fixed cost Variable storage cost 0.6 0.5 Variable handling cost 1.3 1.1 Total operating cost 4.6 4.1 When the warehouse investment was authorised it was agreed that the assets employed and the actual expenses were to be apportioned between the divisions con- cerned in the proportions originally agreed (50 per cent each). However, it was also pointed out that in the future the situation could be redesigned and there was no need for one single basis to apply. For example, the space occupied by inventories of the two divisions is now A 40 per cent and B 60 per cent. This information could be used in the apportionment of assets and expenses. Required: (a) (1) Calculate the actual return on investment (RON for Divisions A and B after incor- porating the warehouse assets and actual costs apportioned on an equal basis as originally agreed (2) What basis of apportionment of assets and actual costs would the manager of Division A argue for, in order to maximise the reported ROI of the division? How would you anticipate that the manager of Division B might react? (b) It has been pointed out that a combination of bases of apportionment may be used instead of just one, such as the space occupied by inventories (A 40 per cent, B 60 per cent) or the level of actual or budgeted sales revenue. If you were given the free dom to revise the calculation, what bases of apportionment would you recommend in the circumstances? Discuss your approach and recalculate the ROI of Division A on your recommended basis. Work to two places of decimals only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts