Question: Please show working out!! :) Q1 Equity valuation You are looking for a growth stock to add to your portfolio, and are interested in BGJO

Please show working out!! :)

Please show working out!! :)

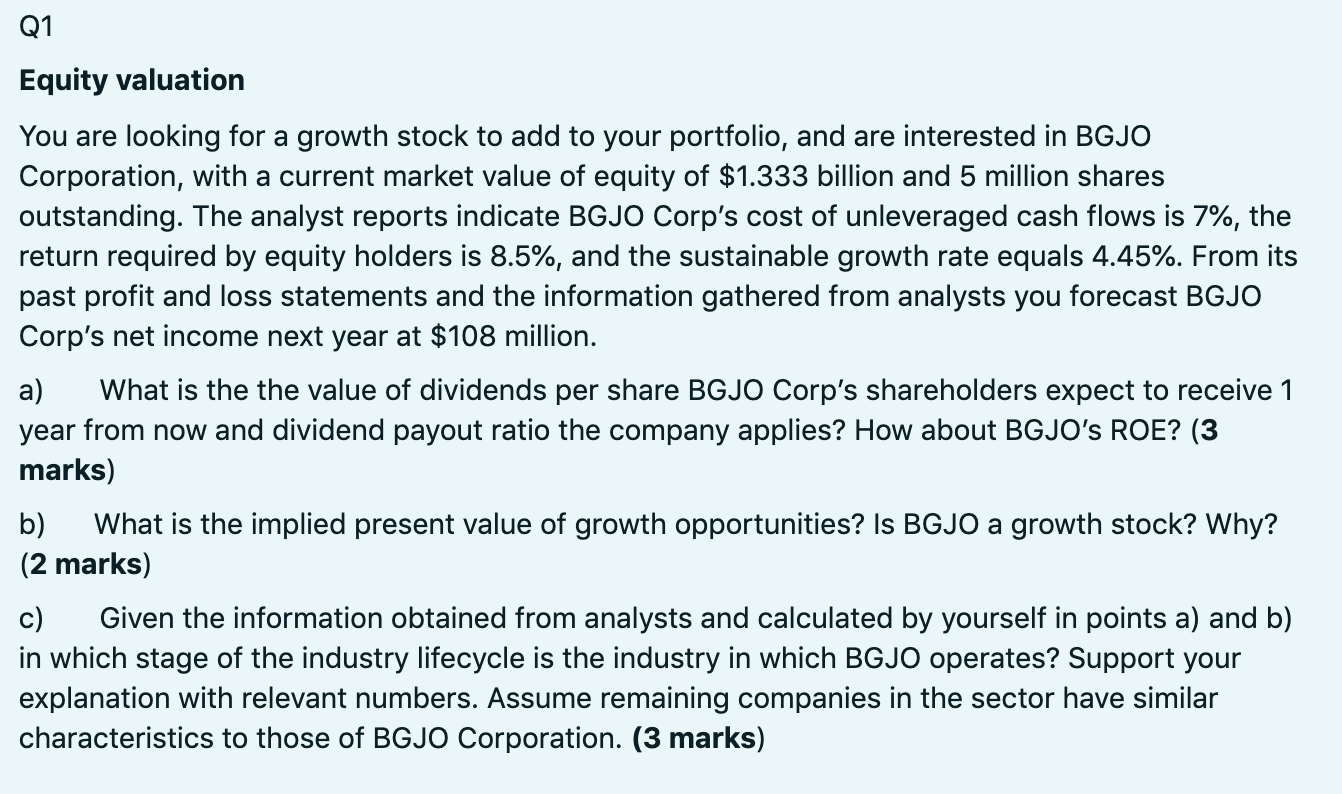

Q1 Equity valuation You are looking for a growth stock to add to your portfolio, and are interested in BGJO Corporation, with a current market value of equity of $1.333 billion and 5 million shares outstanding. The analyst reports indicate BGJO Corp's cost of unleveraged cash flows is 7%, the return required by equity holders is 8.5%, and the sustainable growth rate equals 4.45%. From its past profit and loss statements and the information gathered from analysts you forecast BGJO Corp's net income next year at $108 million. a) What is the the value of dividends per share BGJO Corp's shareholders expect to receive year from now and dividend payout ratio the company applies? How about BGJO's ROE? (3 marks) b) What is the implied present value of growth opportunities? Is BGJO a growth stock? Why? (2 marks) c) Given the information obtained from analysts and calculated by yourself in points a) and b) in which stage of the industry lifecycle is the industry in which BGJO operates? Support your explanation with relevant numbers. Assume remaining companies in the sector have similar characteristics to those of BGJO Corporation. (3 marks) Q1 Equity valuation You are looking for a growth stock to add to your portfolio, and are interested in BGJO Corporation, with a current market value of equity of $1.333 billion and 5 million shares outstanding. The analyst reports indicate BGJO Corp's cost of unleveraged cash flows is 7%, the return required by equity holders is 8.5%, and the sustainable growth rate equals 4.45%. From its past profit and loss statements and the information gathered from analysts you forecast BGJO Corp's net income next year at $108 million. a) What is the the value of dividends per share BGJO Corp's shareholders expect to receive year from now and dividend payout ratio the company applies? How about BGJO's ROE? (3 marks) b) What is the implied present value of growth opportunities? Is BGJO a growth stock? Why? (2 marks) c) Given the information obtained from analysts and calculated by yourself in points a) and b) in which stage of the industry lifecycle is the industry in which BGJO operates? Support your explanation with relevant numbers. Assume remaining companies in the sector have similar characteristics to those of BGJO Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts