Question: please show working Q2. Write your calculations please. (15 points) VXX is the 1x vix futures ETF ETF SVXY manages leverage of -0.5x of vix

please show working

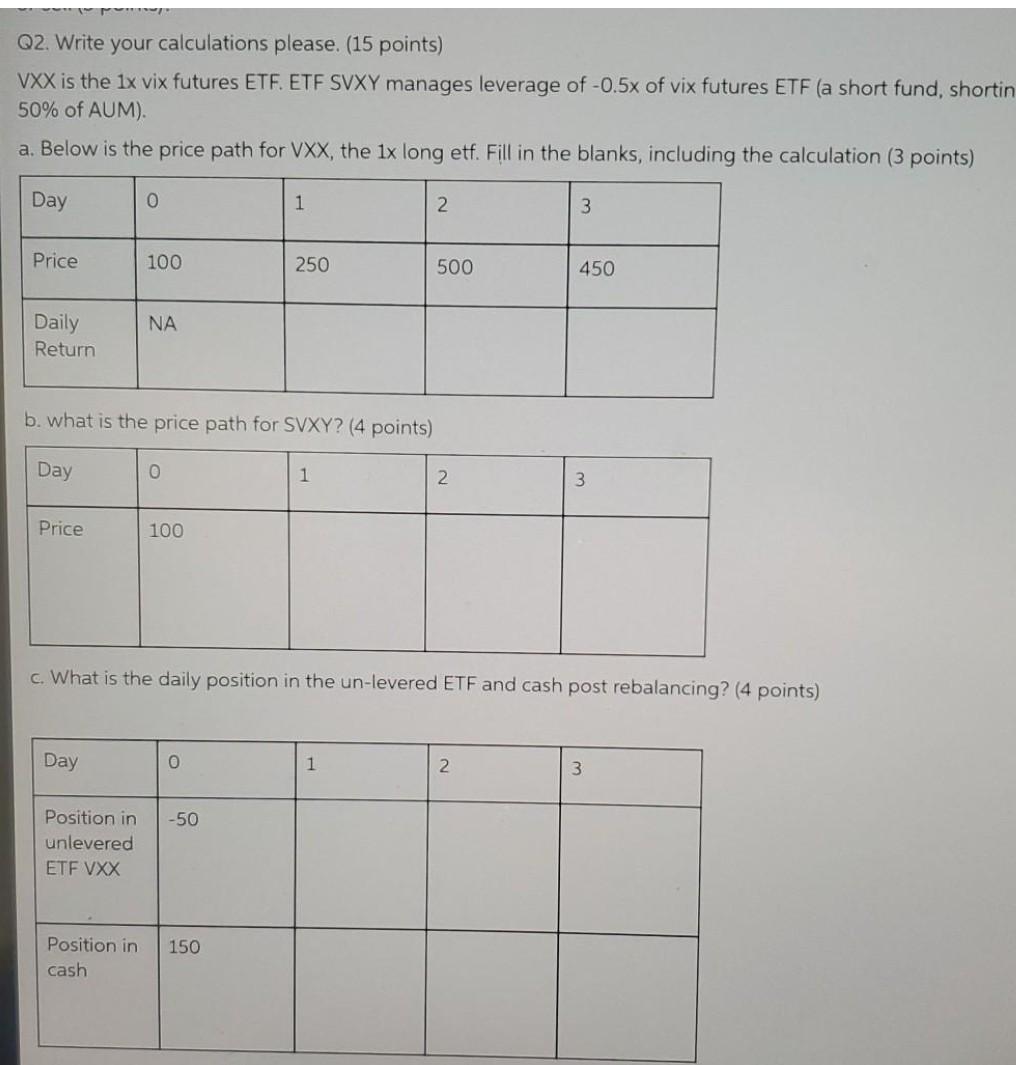

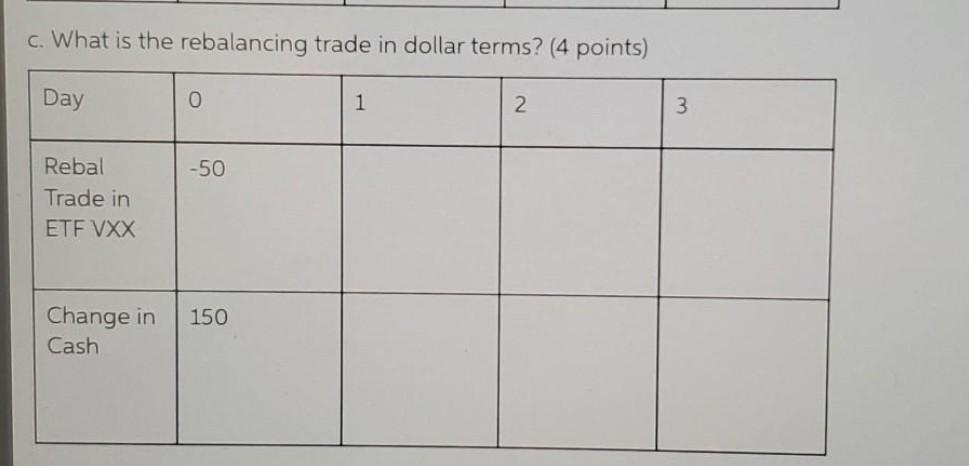

Q2. Write your calculations please. (15 points) VXX is the 1x vix futures ETF ETF SVXY manages leverage of -0.5x of vix futures ETF (a short fund, shortin 50% of AUM). a. Below is the price path for VXX, the 1x long etf. Fill in the blanks, including the calculation (3 points) Day 0 1 2 3 Price 100 250 500 450 NA Daily Return b. what is the price path for SVXY? (4 points) Day 1 2. 3 Price 100 c. What is the daily position in the un-levered ETF and cash post rebalancing? (4 points) Day 0 1 2 3 -50 Position in unlevered ETF VXX 150 Position in cash c. What is the rebalancing trade in dollar terms? (4 points) Day 0 1 2 3 -50 Rebal Trade in ETF VXX 150 Change in Cash Q2. Write your calculations please. (15 points) VXX is the 1x vix futures ETF ETF SVXY manages leverage of -0.5x of vix futures ETF (a short fund, shortin 50% of AUM). a. Below is the price path for VXX, the 1x long etf. Fill in the blanks, including the calculation (3 points) Day 0 1 2 3 Price 100 250 500 450 NA Daily Return b. what is the price path for SVXY? (4 points) Day 1 2. 3 Price 100 c. What is the daily position in the un-levered ETF and cash post rebalancing? (4 points) Day 0 1 2 3 -50 Position in unlevered ETF VXX 150 Position in cash c. What is the rebalancing trade in dollar terms? (4 points) Day 0 1 2 3 -50 Rebal Trade in ETF VXX 150 Change in Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts