Question: please show workings and explanation 9. During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable

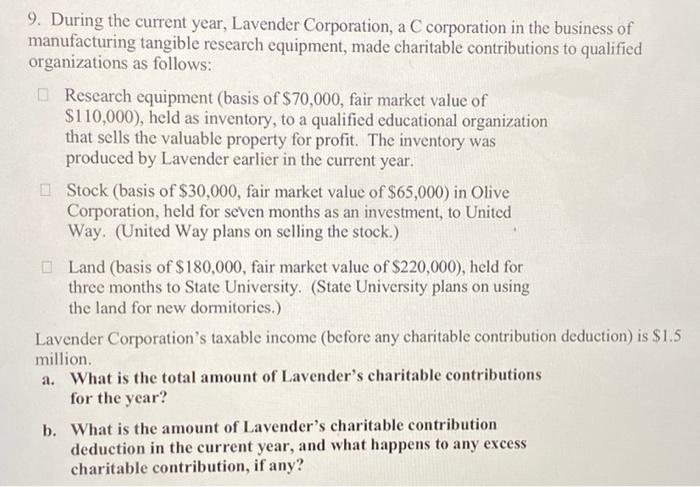

9. During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows: Research equipment (basis of $70,000, fair market value of $110,000), held as inventory, to a qualified educational organization that sells the valuable property for profit. The inventory was produced by Lavender earlier in the current year. I Stock (basis of $30,000, fair market value of $65,000) in Olive Corporation, held for seven months as an investment, to United Way. (United Way plans on selling the stock.) Land (basis of $180,000, fair market value of $220,000), held for three months to State University. (State University plans on using the land for new dormitories.) Lavender Corporation's taxable income (before any charitable contribution deduction) is $1.5 million a. What is the total amount of Lavender's charitable contributions for the year? b. What is the amount of Lavender's charitable contribution deduction in the current year, and what happens to any excess charitable contribution, if any

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts