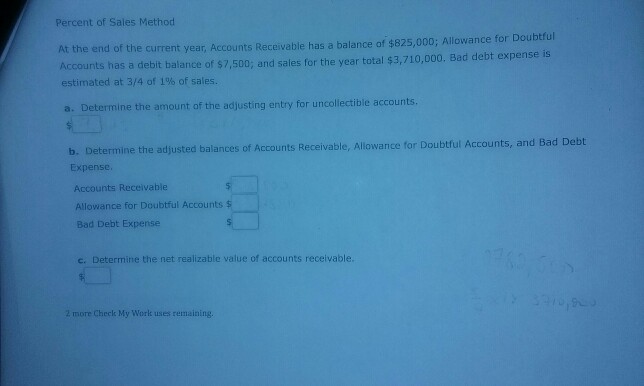

Question: please show workings for each question especially b. how do you calculate allowance for doubtful accounts when credit balance is not given? Percent of Sales

please show workings for each question especially b. how do you calculate allowance for doubtful accounts when credit balance is not given?

Percent of Sales Method d of the current year, Accounts Receivable has a balance of $825,000; Allowance for Doubtful es for the year total $3,710,000. Bad debt expense is Accounts has a debit balance of $7,500; and sal estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. 2 more Checlc My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts