Question: PLEASE SHOW WORK/INPUTS TO FINANCIAL CALCULATOR, NO EXCEL PLEASE Question 3 Consider a bond paying a coupon rate of 14.00% per year semiannually when the

PLEASE SHOW WORK/INPUTS TO FINANCIAL CALCULATOR, NO EXCEL PLEASE

PLEASE SHOW WORK/INPUTS TO FINANCIAL CALCULATOR, NO EXCEL PLEASE

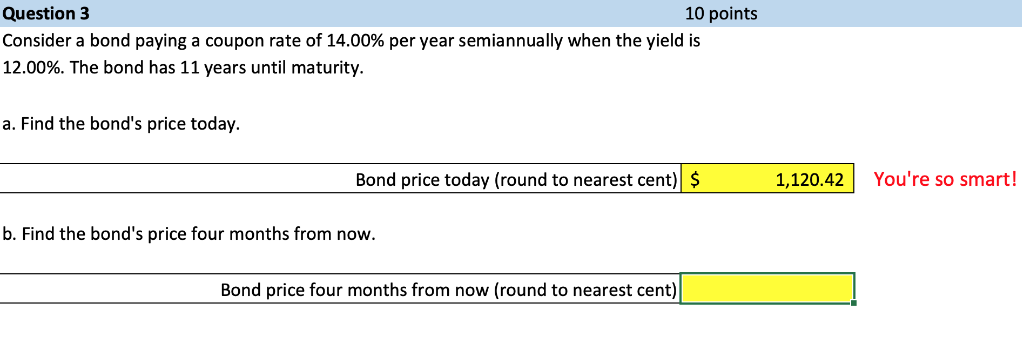

Question 3 Consider a bond paying a coupon rate of 14.00% per year semiannually when the yield is 12.00%. The bond has 11 years until maturity. 10 points a. Find the bond's price today Bond price today (round to nearest cent)S 1,120.42 You're so smart b. Find the bond's price four months from now Bond price four months from now (round to nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts