Question: Please show work/steps with a formula or excel. 1. what is the arithmetic growth rate of the dividends? 2. what is the geometric growth rate

Please show work/steps with a formula or excel.

Please show work/steps with a formula or excel.

1. what is the arithmetic growth rate of the dividends?

2. what is the geometric growth rate of the dividends?

3. what is the required rate of return?

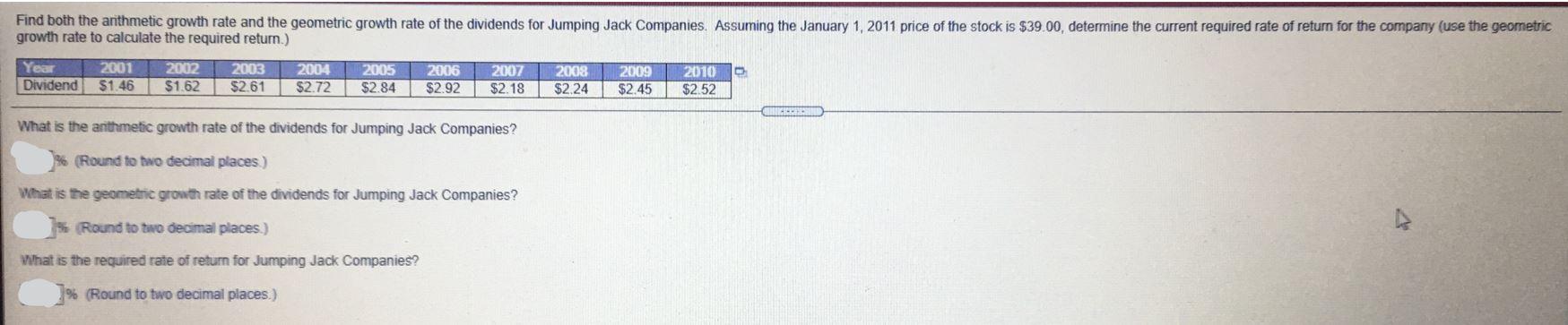

Find both the arithmetic growth rate and the geometric growth rate of the dividends for Jumping Jack Companies. Assuming the January 1, 2011 price of the stock is $39.00, determine the current required rate of return for the company (use the geometric growth rate to calculate the required return.) Year Dividend 2001 $1.46 2002 $1.62 2003 $2.61 2004 $2.72 2005 $2.84 2006 $2.92 2007 $2.18 2008 $2.24 2009 $2.45 2010 $2.52 What is the anthmetic growth rate of the dividends for Jumping Jack Companies? % (Round to two decimal places) What is the geometric growth rate of the dividends for Jumping Jack Companies? % (Round to two decimal places) What is the required rate of return for Jumping Jack Companies? (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts