Question: Please show you work with this, thanks for your help. Tea Inc. is using the current rate method for translation. a. The European subsidiary of

Please show you work with this, thanks for your help.

Please show you work with this, thanks for your help.

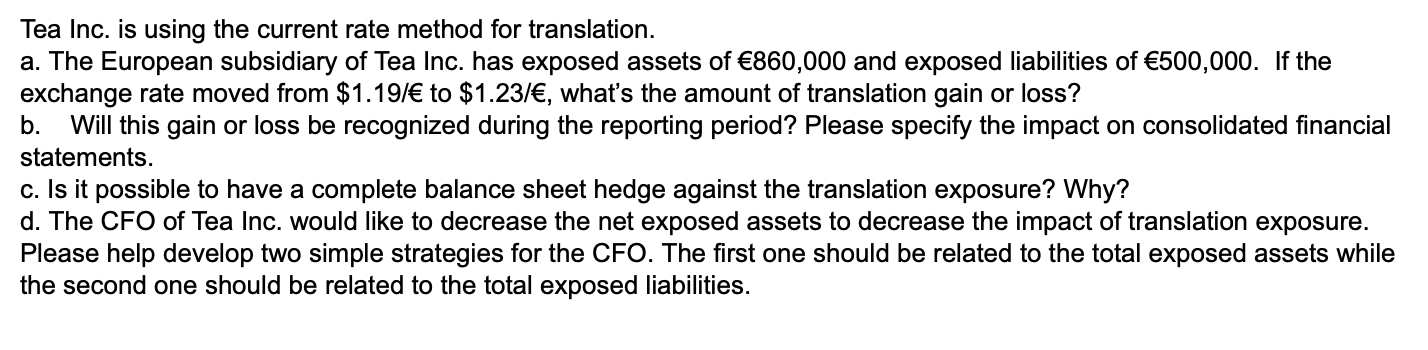

Tea Inc. is using the current rate method for translation. a. The European subsidiary of Tea Inc. has exposed assets of 860,000 and exposed liabilities of 500,000. If the exchange rate moved from $1.19/ to $1.23/, what's the amount of translation gain or loss? b. Will this gain or loss be recognized during the reporting period? Please specify the impact on consolidated financial statements. c. Is it possible to have a complete balance sheet hedge against the translation exposure? Why? d. The CFO of Tea Inc. would like to decrease the net exposed assets to decrease the impact of translation exposure. Please help develop two simple strategies for the CFO. The first one should be related to the total exposed assets while the second one should be related to the total exposed liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts