Question: Please show your excel work for eaxh quesion. Thank you. 21) A firm is evaluating three capital projects. The net present values for the projects

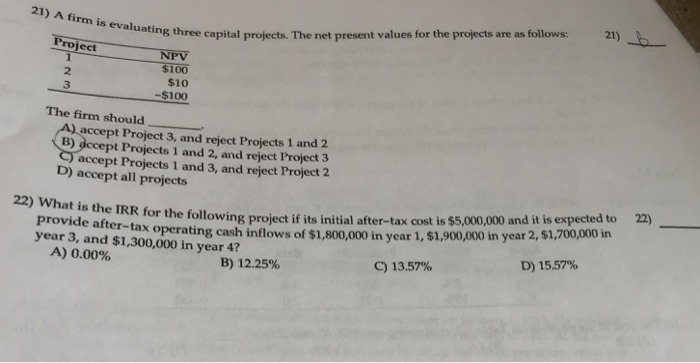

21) A firm is evaluating three capital projects. The net present values for the projects are as follows: Project 2 3 $100 $10 -$100 The firm should A) accept Project 3, and reject Projects 1 and 2 B) dccept Projects 1 and 2, and reject Project 3 accept Projects 1 and 3, and reject Project 2 D) accept all projects for the following project if its initial after-tax cost is $5,000,000 and it is expected to x operating cash inflows of $1,800,000 in year 1, $1,900,000 in year 2, $1,700,000 in 22) 22) What is the IRR provide after-ta year 3, and $1,300,000 in year 4? D) 15.57% A) 0.00% B) 12.25% C) 13.57%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts