Question: Please show your excel work for eaxh quesion. Thank you. 9) Jia's recently paid a $2 annual dividend. The company is projecting fory thereafter. Baercent

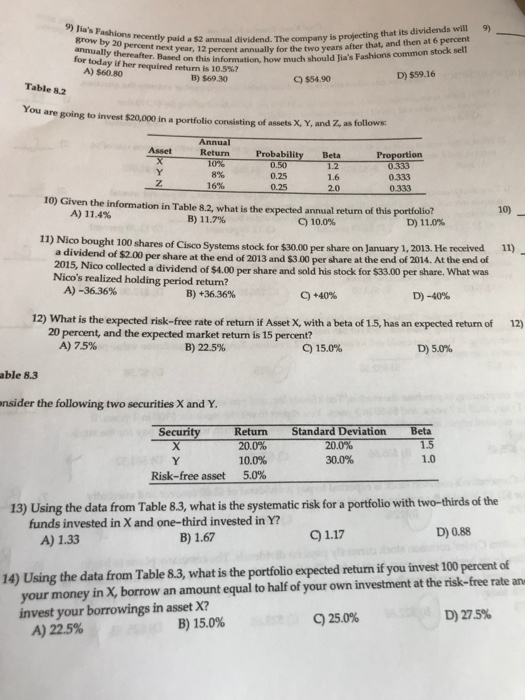

9) Jia's recently paid a $2 annual dividend. The company is projecting fory thereafter. Baercent annually for the two years after that, and then at 6 percent information, how much should lia's Fashions common stock sell grow by 20 today if her required return is 10.5%? A) $60.80 B) $69.30 C) $54.90 D) $59.16 Table 8.2 You are going to invest $20,000 in a portfolio consisting of ansets X, Y, and Z, as follows Annu Asset ReturnProbability Beta 1.2 1.6 2.0 Proportion 8% 16% 0.25 0.25 0.333 0.333 10) Given the information in Table 8.2, what is the expected annual return of this portfolio? 10) A) 11.4% B) 11.7% C) 10.0% D) 11.0% 11) Nico bought 100 shares of Cisco Systems stock for $30.00 per share on January 1, 2013. He received 11) a dividend of $2.00 per share at the end of 2013 and $3.00 per share at the end of 2014. At the end of 2015, Nico collected a dividend of $4.00 per share and sold his stock for $33.00 per share. What was Nico's realized holding period return? A)-3636% B) +36.36% D)-40% C) +40% 12) What is the expected risk-free rate of return if Asset X, with a beta of 1.5, has an expected return of 12) 20 percent, and the expected market return is 15 percent? A)7596 B) 22.5% C) 15.0% D)50% able 8.3 nsider the following two securities X and Y. SecurityReturn Standard Deviation Beta 20.0% 10.0% 5.0% 1.0 Risk-free asset 13) Using the data from Table 8.3, what is the systematic risk for a portfolio with two-thirds of the funds invested in X and one-third invested in Y? B) 1.67 C) 1.17 D) 0.88 A) 1.33 return if you invest 100 percent of 14) Using the data from Table 8.3, what is the portfolio expected your money in X, borrow an amount equal to half of your own investment at the risk-free rate an invest your borrowings in asset X? 9 25.0% D)275% B) 15.0% A)22.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts