Question: Please show your full steps even you are using a calculator. 1) Guggenheim, Inc. offers a 6.25 percent coupon bond with annual payments. The yield

Please show your full steps even you are using a calculator.

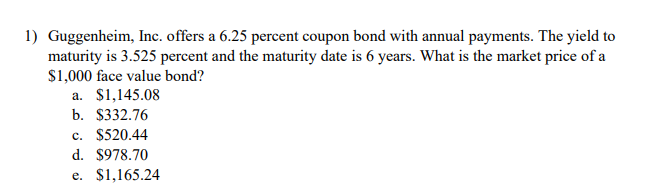

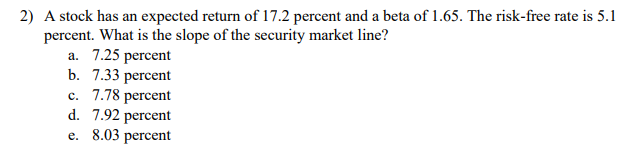

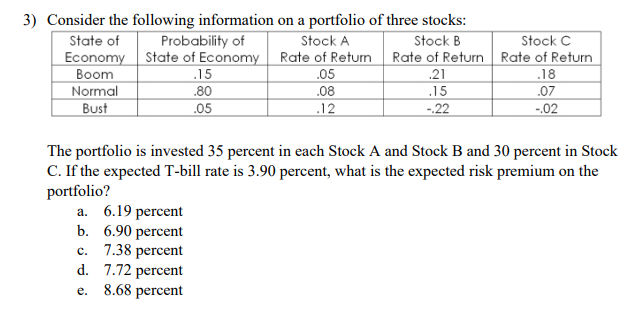

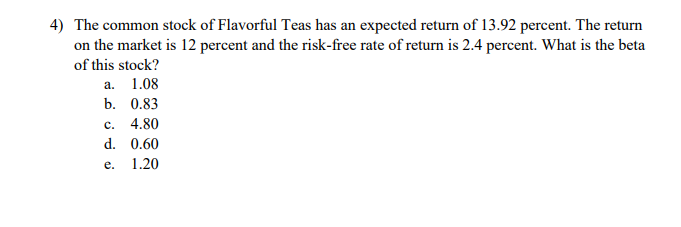

1) Guggenheim, Inc. offers a 6.25 percent coupon bond with annual payments. The yield to maturity is 3.525 percent and the maturity date is 6 years. What is the market price of a $1,000 face value bond? a. $1,145.08 b. $332.76 c. $520.44 d. $978.70 e. $1,165.24 2) A stock has an expected return of 17.2 percent and a beta of 1.65. The risk-free rate is 5.1 percent. What is the slope of the security market line? a. 7.25 percent b. 7.33 percent c. 7.78 percent d. 7.92 percent e. 8.03 percent 3) Consider the following information on a portfolio of three stocks: State of Probability of Stock A Stock B Stock C Economy State of Economy Rate of Return Rate of Return Rate of Return Boom .15 .05 .21 .18 Normal .80 .08 .15 .07 Bust 1.05 .12 -22 -02 The portfolio is invested 35 percent in each Stock A and Stock B and 30 percent in Stock C. If the expected T-bill rate is 3.90 percent, what is the expected risk premium on the portfolio? a. 6.19 percent b. 6.90 percent c. 7.38 percent d. 7.72 percent e. 8.68 percent 4) The common stock of Flavorful Teas has an expected return of 13.92 percent. The return on the market is 12 percent and the risk-free rate of return is 2.4 percent. What is the beta of this stock? a. 1.08 b. 0.83 4.80 d. 0.60 1.20 c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts