Question: Please Show Your Steps! Question 3 part a) How much would you pay for an asset that pays $500 at the end of every three

Please Show Your Steps!

Please Show Your Steps!

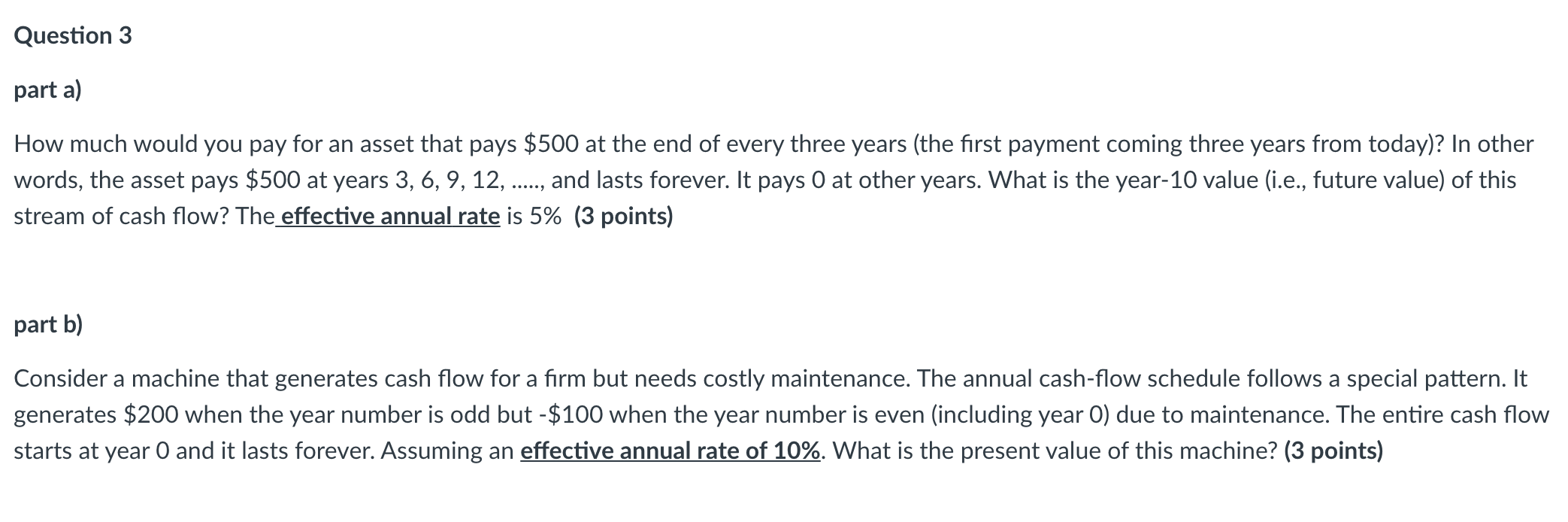

Question 3 part a) How much would you pay for an asset that pays $500 at the end of every three years (the first payment coming three years from today)? In other words, the asset pays $500 at years 3, 6, 9, 12, ....., and lasts forever. It pays 0 at other years. What is the year-10 value (i.e., future value) of this stream of cash flow? The effective annual rate is 5% (3 points) part b) Consider a machine that generates cash flow for a firm but needs costly maintenance. The annual cash-flow schedule follows a special pattern. It generates $200 when the year number is odd but -$100 when the year number is even (including year O) due to maintenance. The entire cash flow starts at year 0 and it lasts forever. Assuming an effective annual rate of 10%. What is the present value of this machine? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts