Question: Please show your steps to get partial credit. In a simple economy, there are two economic states: good and bad. A hedge fund invests in

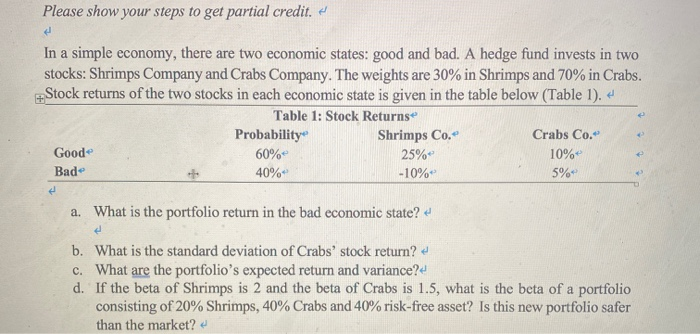

Please show your steps to get partial credit. In a simple economy, there are two economic states: good and bad. A hedge fund invests in two stocks: Shrimps Company and Crabs Company. The weights are 30% in Shrimps and 70% in Crabs. Stock returns of the two stocks in each economic state is given in the table below (Table 1). Table 1: Stock Returns Probability Shrimps Co. Crabs Co. Good 60% 25% 10%+ Bad 40%- -10% 5% a. What is the portfolio return in the bad economic state? b. What is the standard deviation of Crabs' stock return? c. What are the portfolio's expected return and variance? d. If the beta of Shrimps is 2 and the beta of Crabs is 1.5, what is the beta of a portfolio consisting of 20% Shrimps, 40% Crabs and 40% risk-free asset? Is this new portfolio safer than the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts