Question: please show your work and do not use excel so i can easily understand. tysm!! Question 5 (5 points) You are the buyer and are

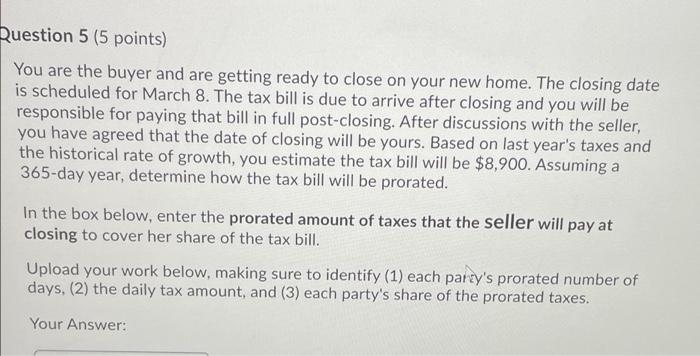

Question 5 (5 points) You are the buyer and are getting ready to close on your new home. The closing date is scheduled for March 8. The tax bill is due to arrive after closing and you will be responsible for paying that bill in full post-closing. After discussions with the seller, you have agreed that the date of closing will be yours. Based on last year's taxes and the historical rate of growth, you estimate the tax bill will be $8,900. Assuming a 365-day year, determine how the tax bill will be prorated. In the box below, enter the prorated amount of taxes that the seller will pay at closing to cover her share of the tax bill. Upload your work below, making sure to identify (1) each party's prorated number of days, (2) the daily tax amount, and (3) each party's share of the prorated taxes. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts