Question: please show your work and explain thank you! Singh Development Co. is deciding whether to proceed with Project X. The cost would be $9 million

please show your work and explain thank you!

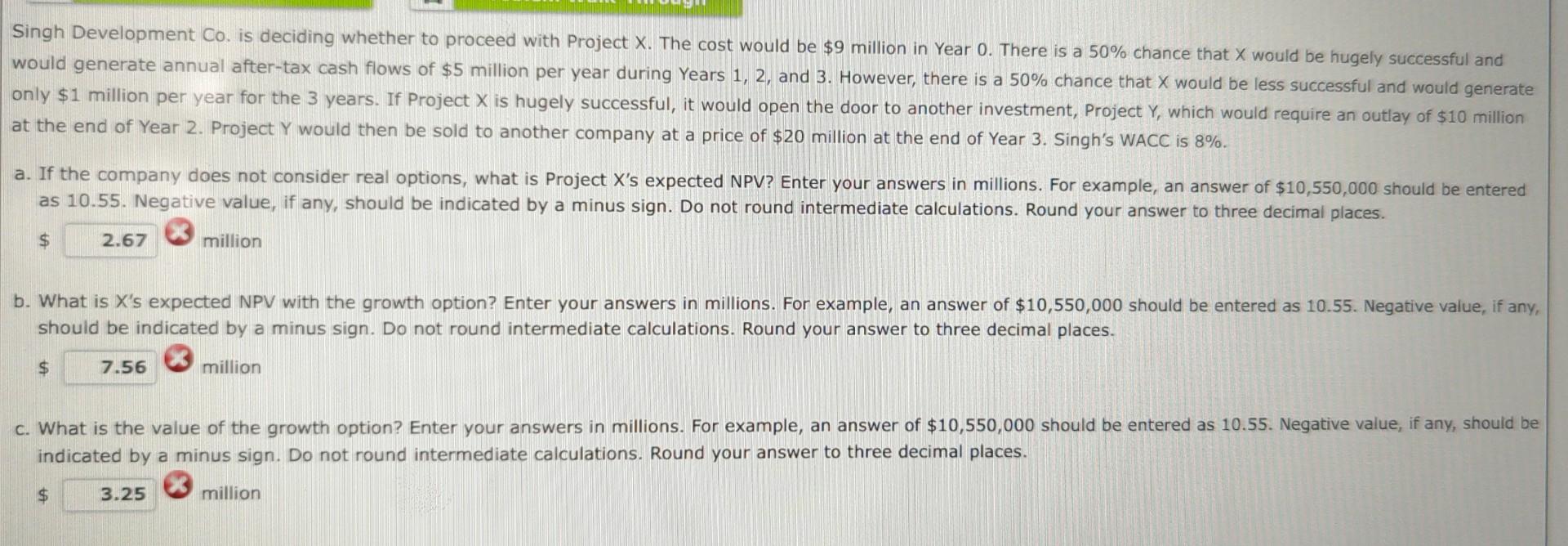

Singh Development Co. is deciding whether to proceed with Project X. The cost would be $9 million in Year 0 . There is a 50% chance that X would be hugely successful and would generate annual after-tax cash flows of $5 million per year during Years 1,2 , and 3 . However, there is a 50% chance that X would be less successful and would generate only $1 million per year for the 3 years. If Project X is hugely successful, it would open the door to another investment, Project Y, which would require an outlay of $10 million at the end of Year 2. Project Y would then be sold to another company at a price of $20 million at the end of Year 3. Singh's WACC is 8%. a. If the company does not consider real options, what is Project X's expected NPV? Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to three decimal places. $ (3) million b. What is X's expected NPV with the growth option? Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to three decimal places. $3 million c. What is the value of the growth option? Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts