Question: please show your work clearly. Chrome File Edit View History Bookmarks People Tab Window Help H 100% 47 Tue 7:18 PM Q DE .. .

please show your work clearly.

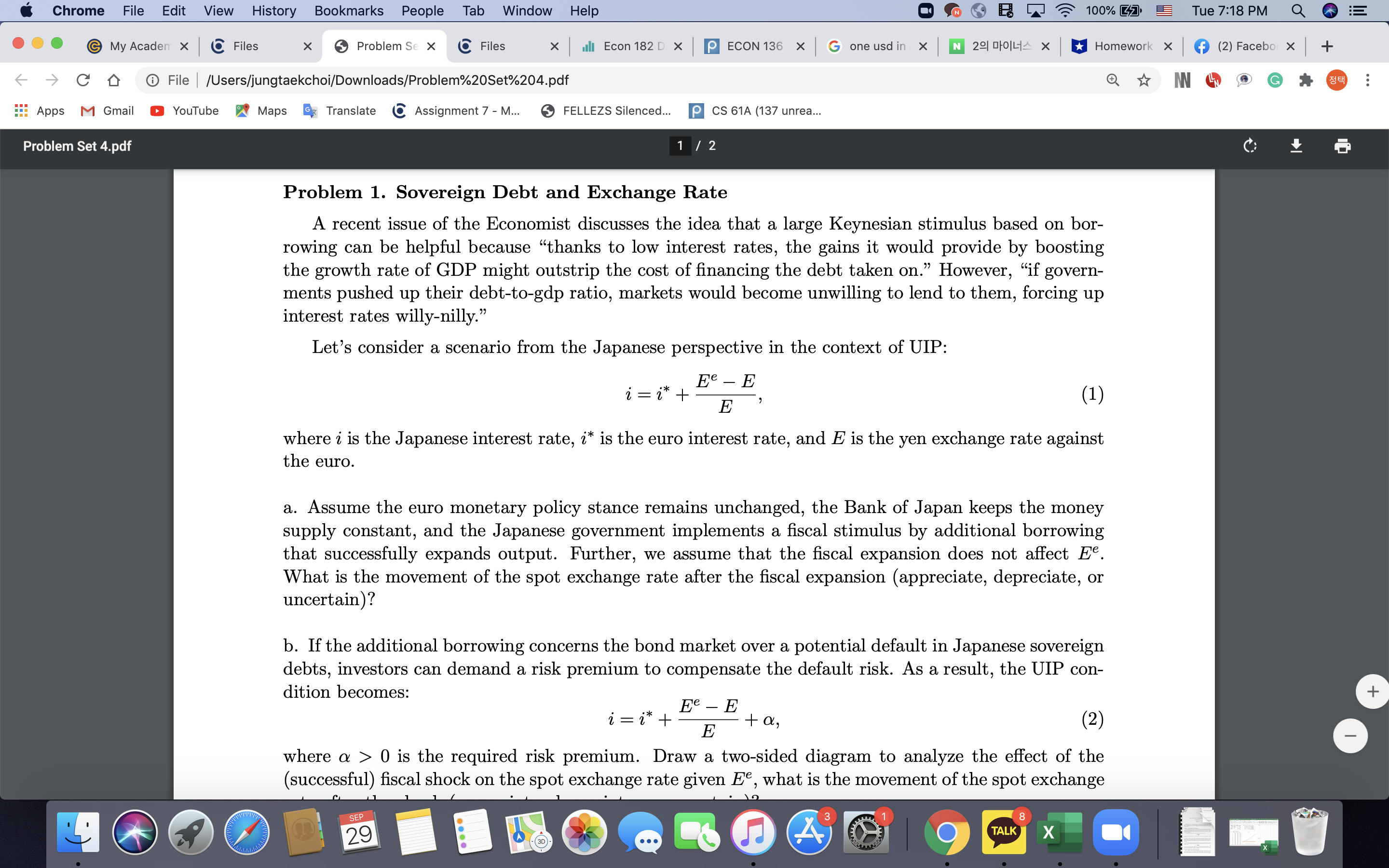

Chrome File Edit View History Bookmarks People Tab Window Help H 100% 47 Tue 7:18 PM Q DE .. . My Acaden X Files X Problem Se X CFiles x ill Econ 182 D X P ECON 136 X G one usd in X N 291 010|4X X Homework X f (2) Facebo X + - - C D @ File | /Users/jungtaekchoi/Downloads/Problem%20Set%204.pdf ... Apps M Gmail YouTube Maps Translate & Assignment 7 - M... FELLEZS Silenced... P CS 61A (137 unrea... Problem Set 4.pdf 1 / 2 Problem 1. Sovereign Debt and Exchange Rate A recent issue of the Economist discusses the idea that a large Keynesian stimulus based on bor- rowing can be helpful because "thanks to low interest rates, the gains it would provide by boosting the growth rate of GDP might outstrip the cost of financing the debt taken on." However, "if govern- ments pushed up their debt-to-gdp ratio, markets would become unwilling to lend to them, forcing up interest rates willy-nilly." Let's consider a scenario from the Japanese perspective in the context of UIP: i = i* + E - E E (1) where i is the Japanese interest rate, i* is the euro interest rate, and E is the yen exchange rate against the euro. a. Assume the euro monetary policy stance remains unchanged, the Bank of Japan keeps the money supply constant, and the Japanese government implements a fiscal stimulus by additional borrowing that successfully expands output. Further, we assume that the fiscal expansion does not affect E. What is the movement of the spot exchange rate after the fiscal expansion (appreciate, depreciate, or uncertain)? b. If the additional borrowing concerns the bond market over a potential default in Japanese sovereign debts, investors can demand a risk premium to compensate the default risk. As a result, the UIP con- dition becomes: + i = i* + E - E E + a , (2) where a > 0 is the required risk premium. Draw a two-sided diagram to analyze the effect of the (successful) fiscal shock on the spot exchange rate given E, what is the movement of the spot exchange SEP 8 29 TALK X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts