Question: please show your work (do not use excel) Problem 1. Steve's Sub Stop (Steve's) is considering investing in toaster ovens for each of its 130

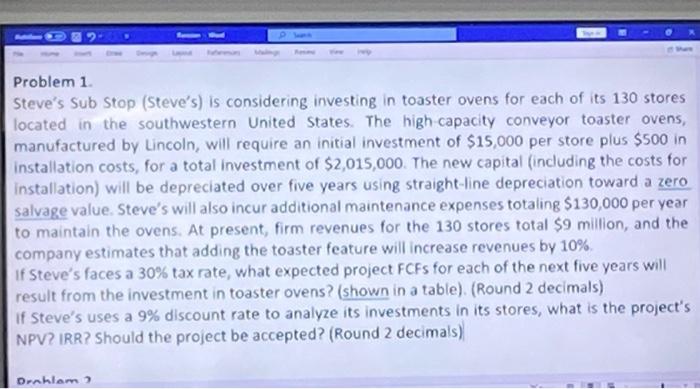

Problem 1. Steve's Sub Stop (Steve's) is considering investing in toaster ovens for each of its 130 stores located in the southwestern United States. The high-capacity conveyor toaster ovens, manufactured by Lincoln, will require an initial investment of $15,000 per store plus $500 in installation costs, for a total investment of $2,015,000. The new capital (including the costs for installation) will be depreciated over five years using straight-line depreciation toward a zero salvage value. Steve's will also incur additional maintenance expenses totaling $130,000 per year to maintain the ovens. At present, firm revenues for the 130 stores total $9 million, and the company estimates that adding the toaster feature will increase revenues by 10%. If Steve's faces a 30% tax rate, what expected project FCFs for each of the next five years will result from the investment in toaster ovens? (shown in a table). (Round 2 decimals) If Steve's uses a 9\% discount rate to analyze its investments in its stores, what is the project's NPV? IRR? Should the project be accepted? (Round 2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts