Question: Please show your work for better understanding. Problems 7 and 8: Bond Price Movements. Bond X is a premium bond making annual payments. The bond

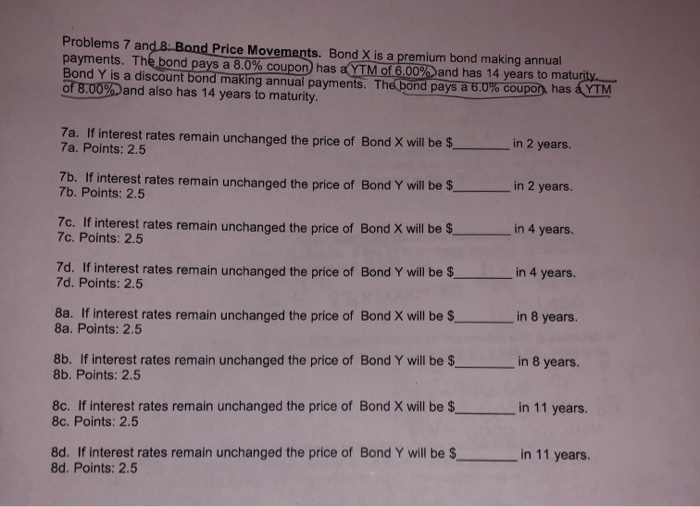

Problems 7 and 8: Bond Price Movements. Bond X is a premium bond making annual payments. The bond pays a 8.0% coupon has a YTM of 6.00% and has 14 years to maturity Bond Y is a discount bond making annual payments. The bond pays a 6.0% coupon has YTM of 8.00% and also has 14 years to maturity. a. If interest rates remain unchanged the price of Bond X will be $ 7a. Points: 2.5 in 2 years 7. If interest rates remain unchanged the price of Bond Y will be $ 7b. Points: 2.5 in 2 years. 7c. If interest rates remain unchanged the price of Bond X will be $ 7c. Points: 2.5 in 4 years. 7d. If interest rates remain unchanged the price of Bond Y will be $_ 7d. Points: 2.5 in 4 years. 8a. If interest rates remain unchanged the price of Bond X will be $_ 8a. Points: 2.5 in 8 years. 8b. If interest rates remain unchanged the price of Bond y will be $ 8b. Points: 2.5 in 8 years. 8c. If interest rates remain unchanged the price of Bond X will be $ 8c. Points: 2.5 in 11 years. 8d. If interest rates remain unchanged the price of Bond Y will be $ 8d. Points: 2.5 in 11 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts