Question: Please show your work if you do it on excel 24. A firm's financial statements for the current year are as follows (in millions of

Please show your work if you do it on excel

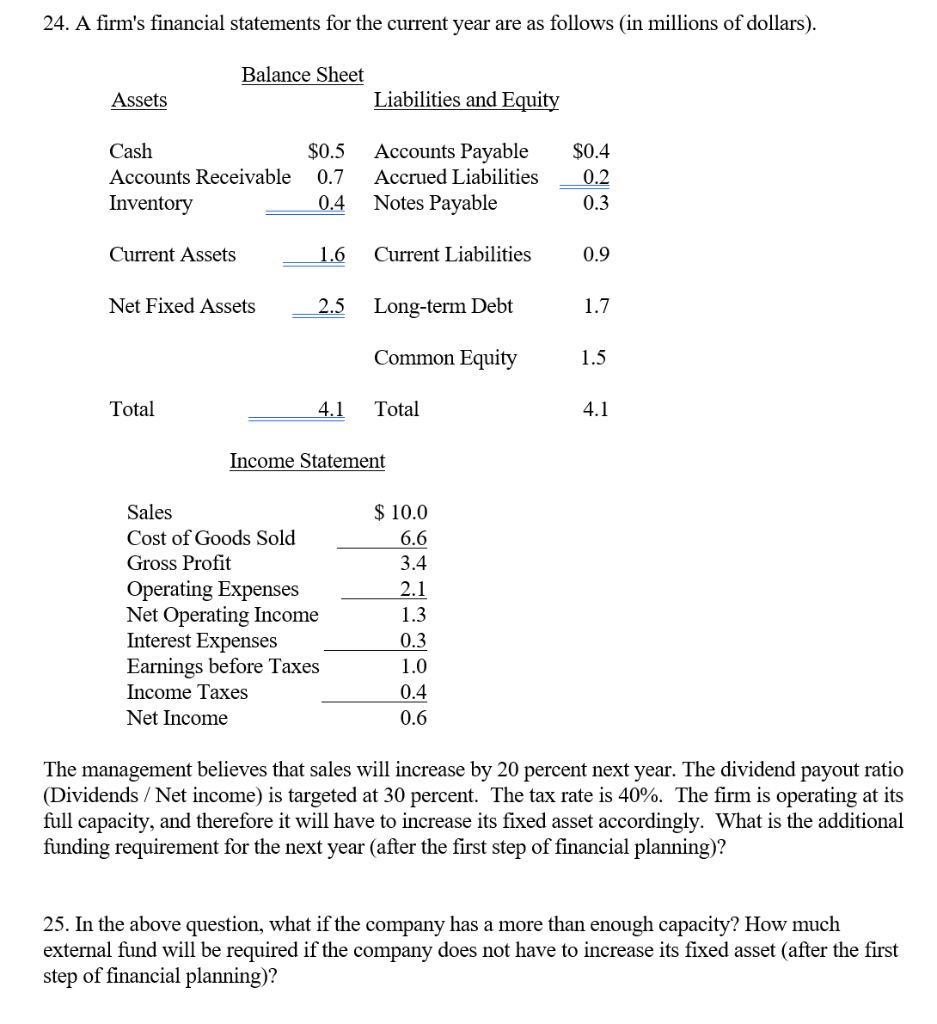

24. A firm's financial statements for the current year are as follows (in millions of dollars). Balance Sheet Assets Liabilities and Equity Cash Accounts Receivable Inventory $0.5 0.7 0.4 Accounts Payable Accrued Liabilities Notes Payable $0.4 0.2 0.3 Current Assets 1.6 Current Liabilities 0.9 Net Fixed Assets 2.5 Long-term Debt 1.7 Common Equity 1.5 Total 4.1 Total 4.1 Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses Net Operating Income Interest Expenses Earnings before Taxes Income Taxes Net Income $ 10.0 6.6 3.4 2.1 1.3 0.3 1.0 0.4 0.6 The management believes that sales will increase by 20 percent next year. The dividend payout ratio (Dividends / Net income) is targeted at 30 percent. The tax rate is 40%. The firm is operating at its full capacity, and therefore it will have to increase its fixed asset accordingly. What is the additional funding requirement for the next year (after the first step of financial planning)? 25. In the above question, what if the company has a more than enough capacity? How much external fund will be required if the company does not have to increase its fixed asset (after the first step of financial planning)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts