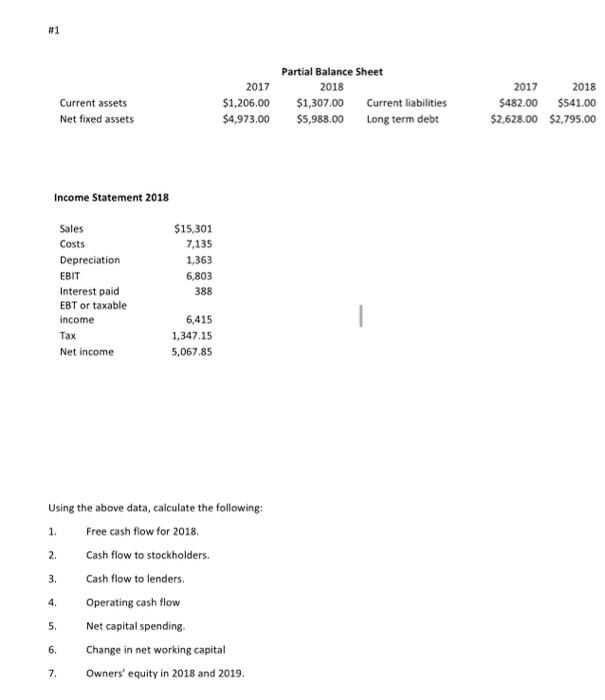

Question: please show your work. im having a hard time understanding. #1 2017 Partial Balance Sheet 2018 $1,307.00 Current liabilities $5,988.00 Long term debt Current assets

#1 2017 Partial Balance Sheet 2018 $1,307.00 Current liabilities $5,988.00 Long term debt Current assets $1,206.00 $4,973.00 2017 2018 $482.00 $541.00 $2,628.00 $2,795.00 Net fixed assets Income Statement 2018 Sales $15,301 7.135 Costs Depreciation EBIT 1,363 6,803 388 Interest paid EBT or taxable income 6,415 1 Tax 1,347.15 Net income 5,067.85 Using the above data, calculate the following: 1. Free cash flow for 2018 2. Cash flow to stockholders. 3. Cash flow to lenders. 4. Operating cash flow 5. Net capital spending 6. Change in net working capital 7. Owners' equity in 2018 and 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts