Question: Please show your work in detail. Preferably using excel! Bullbird Inc.'s 2022 pro forma and 2021 actual balance sheets and income statements are as shown.

Please show your work in detail. Preferably using excel!

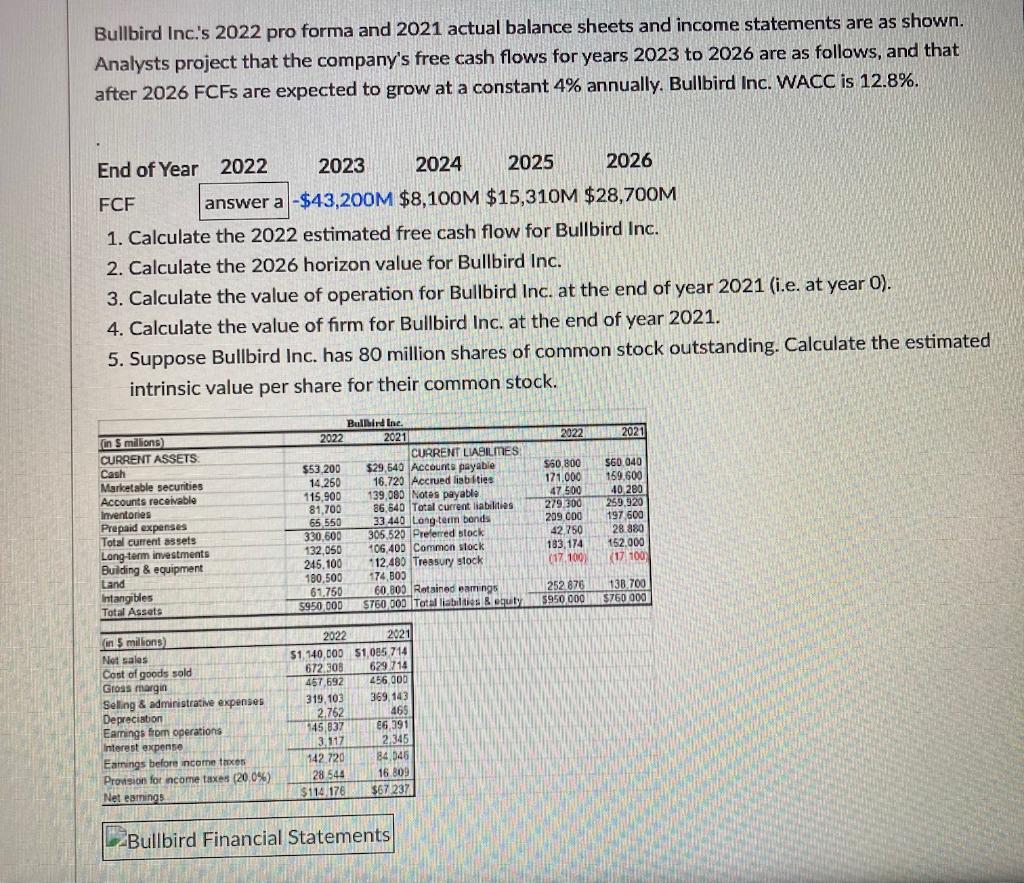

Bullbird Inc.'s 2022 pro forma and 2021 actual balance sheets and income statements are as shown. Analysts project that the company's free cash flows for years 2023 to 2026 are as follows, and that after 2026 FCFs are expected to grow at constant 4% annually. Bullbird Inc. WACC is 12.8%. End of Year 2022 2023 2024 2025 2026 FCF answer a -$43,200M $8,100M $15,310M $28,700M 1. Calculate the 2022 estimated free cash flow for Bullbird Inc. 2. Calculate the 2026 horizon value for Bullbird Inc. 3. Calculate the value of operation for Bullbird Inc. at the end of year 2021 (i.e. at year O). 4. Calculate the value of firm for Bullbird Inc. at the end of year 2021. 5. Suppose Bullbird Inc. has 80 million shares of common stock outstanding. Calculate the estimated intrinsic value per share for their common stock. 2022 202 (in S millions) CURRENT ASSETS Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Long-term investments Building & equipment Land Intangibles Total Assets Bullhind Ine. 2022 2021 CURRENT LIABILMES $53,200 $29,540 Accounts payable 14.250 16.720 Accrued liabities 115.900 139,080 Notes payable 81,700 86.840 Total current liabilities 65 550 33 440 Long term bonds 330.600 306.520 Preferred stock 132,050 406,400 Common stock 112,480 Treasury stock 180,500 174 303 61.750 60.000. Retained eamings 5950 000 ST60 D00 Total liabilities & equity 560,800 171.000 47500 279 300 209 000 42.750 183, 174 (17 100 560 040 159.600 40.280 259.920 197 600 28 880 152.000 (17. 100 NO 138.700 $760 000 245, 100 252 876 5950 000 un 15 millions) Net sales Cost of goods sold Gross margin Selling & administrative expenses Depreciation Earnings from operations Interest expense Earnings before income taxes Provision for ncome taxes (20.0%) Net eamings 2022 2021 51 140,000 51,085 714 672,308 629 714 457 592 456,000 319,103 369,143 2.762 465 145.637 86 391 2.345 142.720 84.546 16 809 $114 176 $67 237 3.117 28 544 Bullbird Financial Statements Bullbird Inc.'s 2022 pro forma and 2021 actual balance sheets and income statements are as shown. Analysts project that the company's free cash flows for years 2023 to 2026 are as follows, and that after 2026 FCFs are expected to grow at constant 4% annually. Bullbird Inc. WACC is 12.8%. End of Year 2022 2023 2024 2025 2026 FCF answer a -$43,200M $8,100M $15,310M $28,700M 1. Calculate the 2022 estimated free cash flow for Bullbird Inc. 2. Calculate the 2026 horizon value for Bullbird Inc. 3. Calculate the value of operation for Bullbird Inc. at the end of year 2021 (i.e. at year O). 4. Calculate the value of firm for Bullbird Inc. at the end of year 2021. 5. Suppose Bullbird Inc. has 80 million shares of common stock outstanding. Calculate the estimated intrinsic value per share for their common stock. 2022 202 (in S millions) CURRENT ASSETS Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Long-term investments Building & equipment Land Intangibles Total Assets Bullhind Ine. 2022 2021 CURRENT LIABILMES $53,200 $29,540 Accounts payable 14.250 16.720 Accrued liabities 115.900 139,080 Notes payable 81,700 86.840 Total current liabilities 65 550 33 440 Long term bonds 330.600 306.520 Preferred stock 132,050 406,400 Common stock 112,480 Treasury stock 180,500 174 303 61.750 60.000. Retained eamings 5950 000 ST60 D00 Total liabilities & equity 560,800 171.000 47500 279 300 209 000 42.750 183, 174 (17 100 560 040 159.600 40.280 259.920 197 600 28 880 152.000 (17. 100 NO 138.700 $760 000 245, 100 252 876 5950 000 un 15 millions) Net sales Cost of goods sold Gross margin Selling & administrative expenses Depreciation Earnings from operations Interest expense Earnings before income taxes Provision for ncome taxes (20.0%) Net eamings 2022 2021 51 140,000 51,085 714 672,308 629 714 457 592 456,000 319,103 369,143 2.762 465 145.637 86 391 2.345 142.720 84.546 16 809 $114 176 $67 237 3.117 28 544 Bullbird Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts