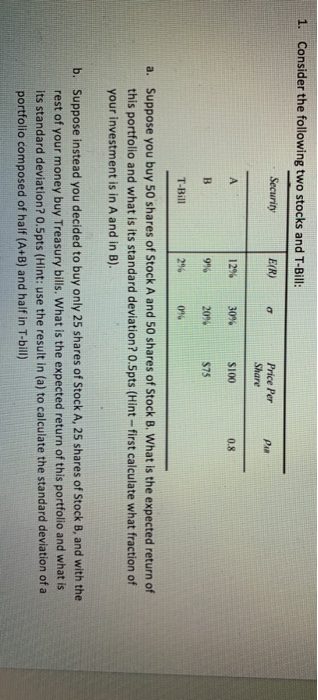

Question: Please show your work in Excel 1. Consider the following two stocks and T-Bill: Security E(R) o Price Per Share Pla S100 0.8 20% $75

Please show your work in Excel

Please show your work in Excel1. Consider the following two stocks and T-Bill: Security E(R) o Price Per Share Pla S100 0.8 20% $75 T-Bill 0% a. Suppose you buy 50 shares of Stock A and 50 shares of Stock B. What is the expected return of this portfolio and what is its standard deviation? 0.5pts (Hint - first calculate what fraction of your investment is in A and in B). b. Suppose instead you decided to buy only 25 shares of Stock A, 25 shares of Stock B, and with the rest of your money buy Treasury bills. What is the expected return of this portfolio and what is its standard deviation? 0.5pts (Hint: use the result in (a) to calculate the standard deviation of a portfolio composed of half (A+B) and half in T-bill)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts