Question: Please show your work on excel for the problem, how you got your answer and for the format in second picture please. Supreme Chancellor Palpatine

Please show your work on excel for the problem, how you got your answer and for the format in second picture please.

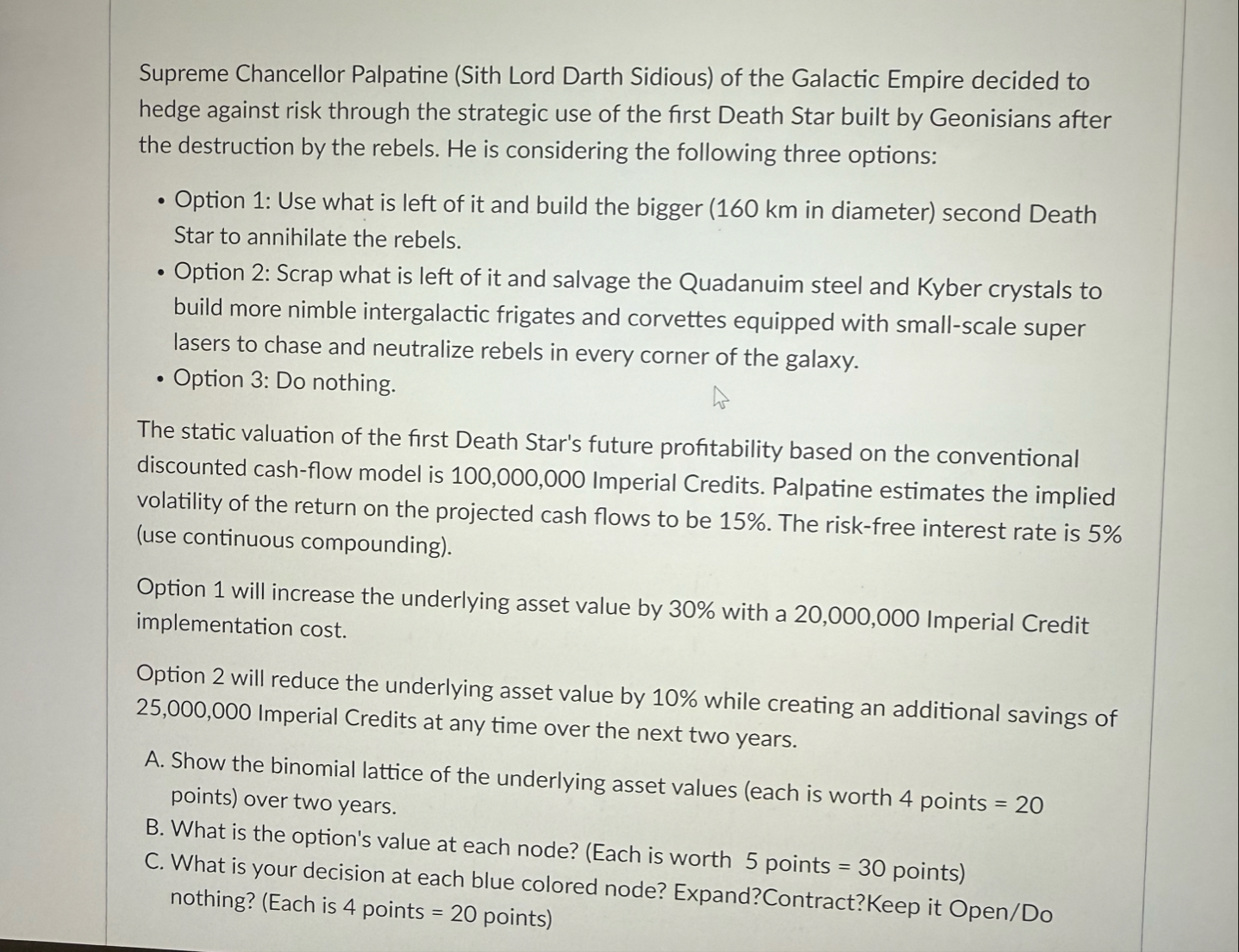

Supreme Chancellor Palpatine Sith Lord Darth Sidious of the Galactic Empire decided to hedge against risk through the strategic use of the first Death Star built by Geonisians after the destruction by the rebels. He is considering the following three options:

Option : Use what is left of it and build the bigger km in diameter second Death Star to annihilate the rebels.

Option : Scrap what is left of it and salvage the Quadanuim steel and Kyber crystals to build more nimble intergalactic frigates and corvettes equipped with smallscale super lasers to chase and neutralize rebels in every corner of the galaxy.

Option : Do nothing.

The static valuation of the first Death Star's future profitability based on the conventional discounted cashflow model is Imperial Credits. Palpatine estimates the implied volatility of the return on the projected cash flows to be The riskfree interest rate is use continuous compounding

Option will increase the underlying asset value by with a Imperial Credit implementation cost.

Option will reduce the underlying asset value by while creating an additional savings of Imperial Credits at any time over the next two years.

A Show the binomial lattice of the underlying asset values each is worth points points over two years.

B What is the option's value at each node? Each is worth points points

C What is your decision at each blue colored node? Expand?Contract?Keep it OpenDo nothing? Each is points pointsPlease help me with this Engineering Econ Stats problem. Please show your work on excel on how you got the answers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock