Question: please show your work Problem 1: From Seifi's book table 5.5 and table 5.6 below Non flat LDC FOR LOLP constraint ENS cost Table 5.5

please show your work

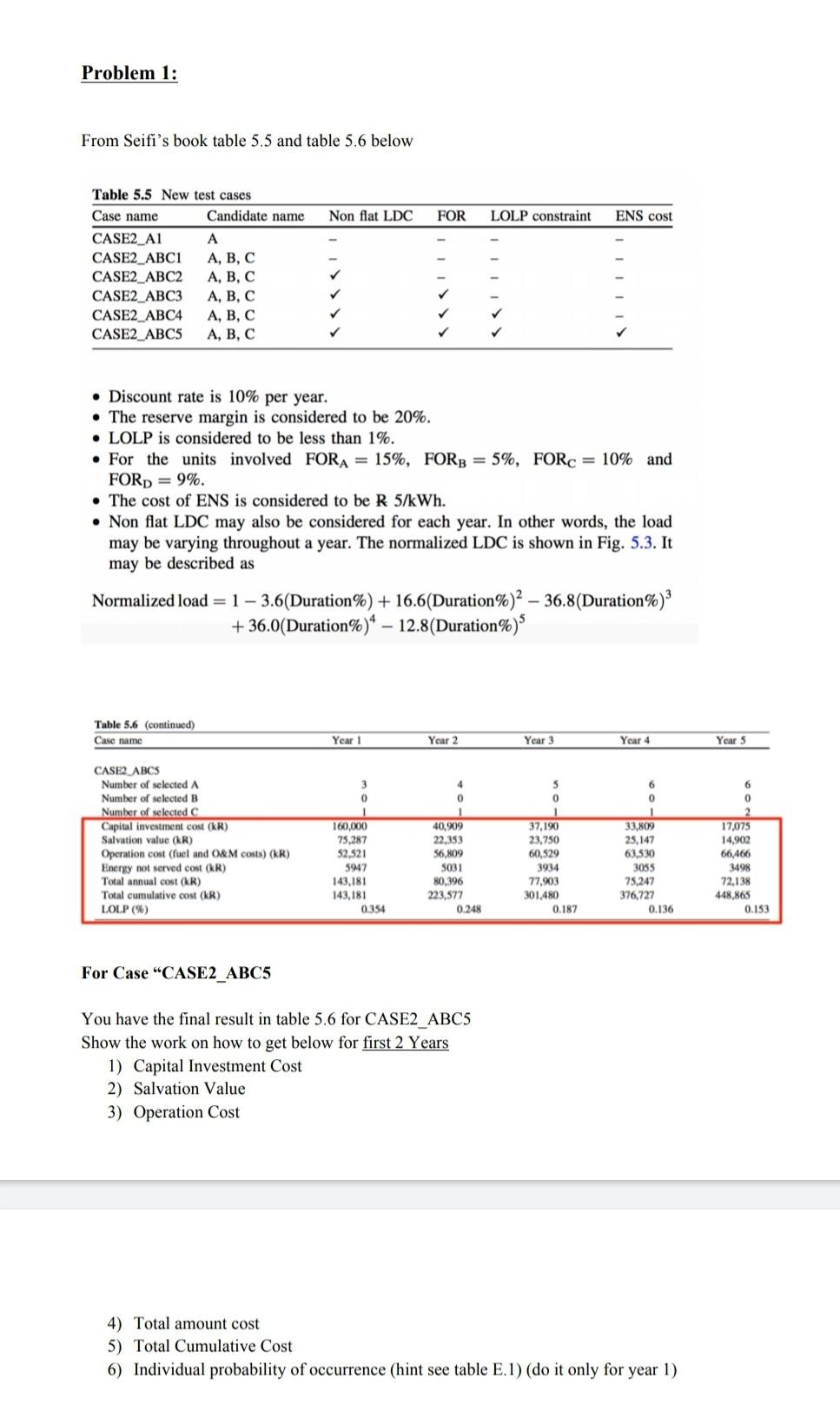

Problem 1: From Seifi's book table 5.5 and table 5.6 below Non flat LDC FOR LOLP constraint ENS cost Table 5.5 New test cases Case name Candidate name CASE2_A1 A CASE2_ABC1 A, B, C CASE2 ABC2 A, B, C CASE2_ABC3 A, B, C CASE2_ABC4 A, B, C CASE2_ABC5 A, B, C Discount rate is 10% per year. The reserve margin is considered to be 20%. LOLP is considered to be less than 1%. For the units involved FORA = 15%, FORB = 5%, FORC = 10% and FORD = 9%. The cost of ENS is considered to be R 5/kWh, Non flat LDC may also be considered for each year. In other words, the load may be varying throughout a year. The normalized LDC is shown in Fig. 5.3. It may be described as Normalized load = 1 3.6(Duration%) + 16.6(Duration%)2 36.8(Duration%) 3 + 36.0(Duration%)* 12.8(Duration%)* Table 5.6 (continued) Case name Year 1 Year 2 Year 3 Year 4 Year 5 6 3 0 6 0 0 160,000 CASE2 ABCS Number of selected A Number of selected B Number of selected Capital investment cost (R) Salvation value (R) Operation cost (fuel and O&M costs) (KR) Energy not served cost (R) Total annual cost (R) Total cumulative cost (KR) LOLP (%) 75,287 52,521 5947 143,181 143,181 0.354 40,909 22,353 56,809 5031 80,396 223,577 0.248 5 0 1 37.190 23,750 60,529 3934 77,903 301,480 0.182 33.809 25,147 63,530 3055 25.242 376,727 0.136 17,075 14,902 66.466 3498 72,138 448,865 0.153 For Case "CASE2_ABC5 You have the final result in table 5.6 for CASE2_ABC5 Show the work on how to get below for first 2 Years 1) Capital Investment Cost 2) Salvation Value 3) Operation Cost 4) Total amount cost 5) Total Cumulative Cost 6) Individual probability of occurrence (hint see table E.1) (do it only for year 1) Problem 1: From Seifi's book table 5.5 and table 5.6 below Non flat LDC FOR LOLP constraint ENS cost Table 5.5 New test cases Case name Candidate name CASE2_A1 A CASE2_ABC1 A, B, C CASE2 ABC2 A, B, C CASE2_ABC3 A, B, C CASE2_ABC4 A, B, C CASE2_ABC5 A, B, C Discount rate is 10% per year. The reserve margin is considered to be 20%. LOLP is considered to be less than 1%. For the units involved FORA = 15%, FORB = 5%, FORC = 10% and FORD = 9%. The cost of ENS is considered to be R 5/kWh, Non flat LDC may also be considered for each year. In other words, the load may be varying throughout a year. The normalized LDC is shown in Fig. 5.3. It may be described as Normalized load = 1 3.6(Duration%) + 16.6(Duration%)2 36.8(Duration%) 3 + 36.0(Duration%)* 12.8(Duration%)* Table 5.6 (continued) Case name Year 1 Year 2 Year 3 Year 4 Year 5 6 3 0 6 0 0 160,000 CASE2 ABCS Number of selected A Number of selected B Number of selected Capital investment cost (R) Salvation value (R) Operation cost (fuel and O&M costs) (KR) Energy not served cost (R) Total annual cost (R) Total cumulative cost (KR) LOLP (%) 75,287 52,521 5947 143,181 143,181 0.354 40,909 22,353 56,809 5031 80,396 223,577 0.248 5 0 1 37.190 23,750 60,529 3934 77,903 301,480 0.182 33.809 25,147 63,530 3055 25.242 376,727 0.136 17,075 14,902 66.466 3498 72,138 448,865 0.153 For Case "CASE2_ABC5 You have the final result in table 5.6 for CASE2_ABC5 Show the work on how to get below for first 2 Years 1) Capital Investment Cost 2) Salvation Value 3) Operation Cost 4) Total amount cost 5) Total Cumulative Cost 6) Individual probability of occurrence (hint see table E.1) (do it only for year 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts