Question: Please show your work. Question 6 1 pts A candy factory is building an extension to taffy puller. This will require spending $18 million

\

\

Please show your work.

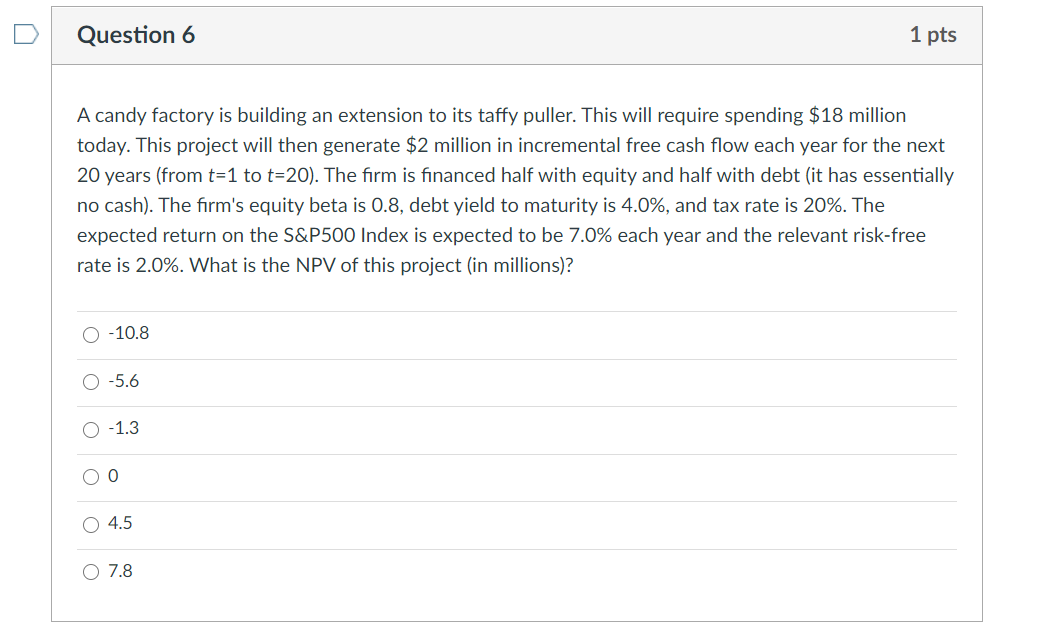

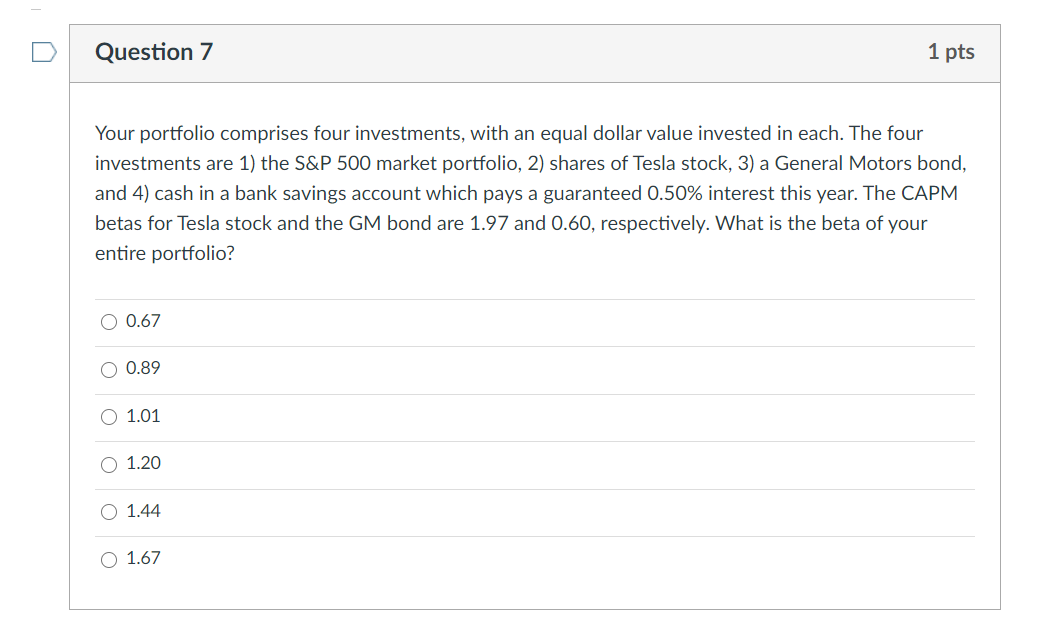

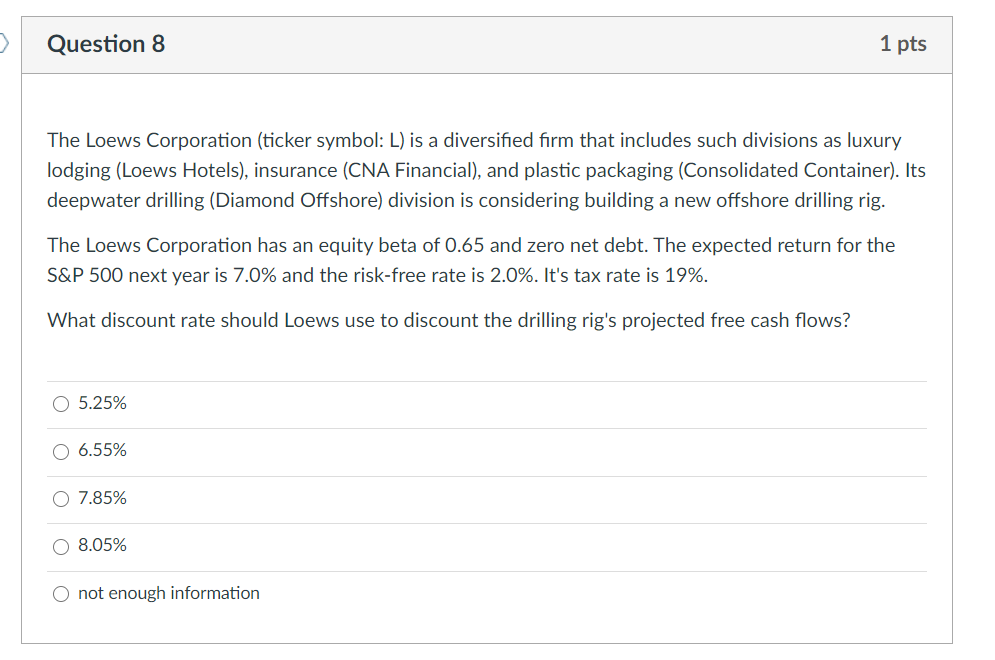

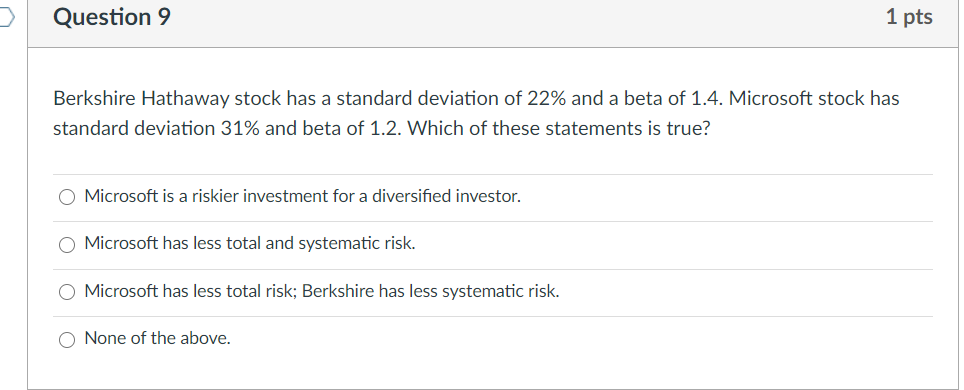

Question 6 1 pts A candy factory is building an extension to taffy puller. This will require spending $18 million today. This project will then generate $2 million in incremental free cash flow each year for the next 20 years (from t=1 to t=20). The firm is financed half with equity and half with debt (it has essentially no cash). The firm's equity beta is 0.8, debt yield to maturity is 4.0%, and tax rate is 20%. The expected return on the S&P500 Index is expected to be 7.0% each year and the relevant risk-free rate is 2.0%. What is the NPV of this project (in millions)? 0 -10.8 0 -5.6 O-1.3 O O 4.5 O 7.8 Question 7 1 pts Your portfolio comprises four investments, with an equal dollar value invested in each. The four investments are 1) the S&P 500 market portfolio, 2) shares of Tesla stock, 3) a General Motors bond, and 4) cash in a bank savings account which pays a guaranteed 0.50% interest this year. The CAPM betas for Tesla stock and the GM bond are 1.97 and 0.60, respectively. What is the beta your entire portfolio? O 0.67 O 0.89 O 1.01 O 1.20 O 1.44 O 1.67 > Question 8 1 pts The Loews Corporation (ticker symbol: L) is a diversified firm that includes such divisions as luxury lodging (Loews Hotels), insurance (CNA Financial), and plastic packaging (Consolidated Container). Its deepwater drilling (Diamond Offshore) division is considering building a new offshore drilling rig. The Loews Corporation has an equity beta of 0.65 and zero net debt. The expected return for the S&P 500 next year is 7.0% and the risk-free rate is 2.0%. It's tax rate is 19%. What discount rate should Loews use to discount the drilling rig's projected free cash flows? O 5.25% O 6.55% O 7.85% 08.05% O not enough information Question 9 1 pts Berkshire Hathaway stock has a standard deviation of 22% and a beta of 1.4. Microsoft stock has standard deviation 31% and beta of 1.2. Which of these statements is true? Microsoft is a riskier investment for a diversified investor. Microsoft has less total and systematic risk. O Microsoft has less total risk; Berkshire has less systematic risk. O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts