Question: Please show your work. Smith Construction Company received a contract on September 30, 2013, to build a warehouse over a period of 18 months. The

Please show your work.

Please show your work.

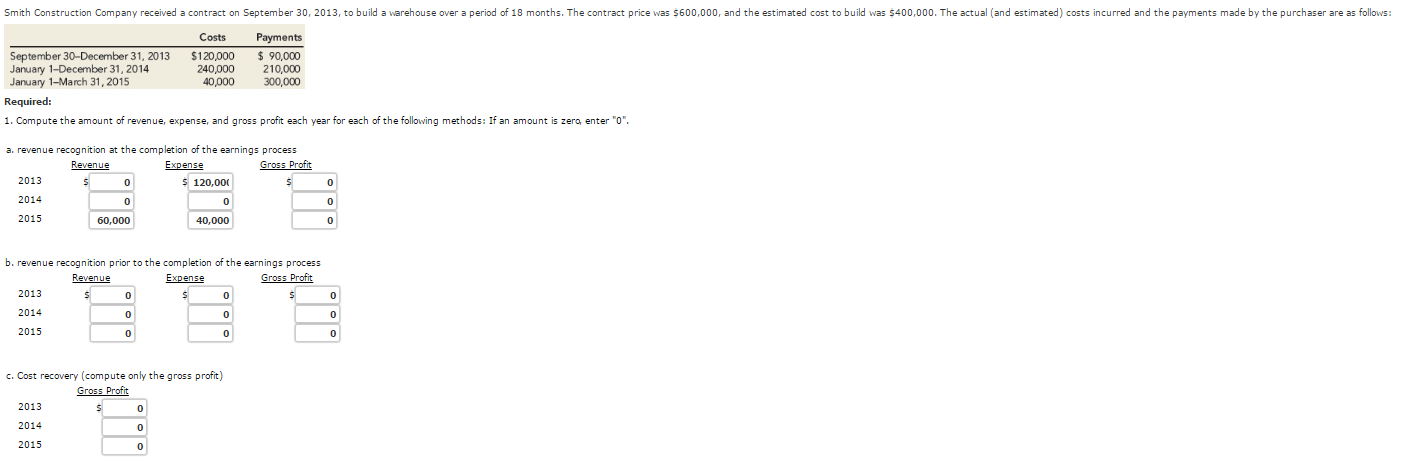

Smith Construction Company received a contract on September 30, 2013, to build a warehouse over a period of 18 months. The contract price was $600,000, and the estimated cost to build was $400,000. The actual (and estimated) costs incurred and the payments made by the purchaser are as follows: Costs Payments September 30-December 31, 2013 $120,000 90,000 January 1-December 31, 2014 240,000 210,000 January 1-March 31, 2015 40,000 300,000 Required: 1. Compute the amount of revenue, expense, and gross profit each year for each of the following methods: If an amount is zero enter "0". a. revenue recognition at the completion of the earnings process 120,000 60,000 40,000 b. revenue recognition prior to the completion of the earnings process Profit c. Cost recovery (compute only the gross profit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts