Question: Please Show your work! Thank you Questions # (1) to # (3) are based on the following information. MacDonald Publishing is considering entering a new

Please Show your work! Thank you

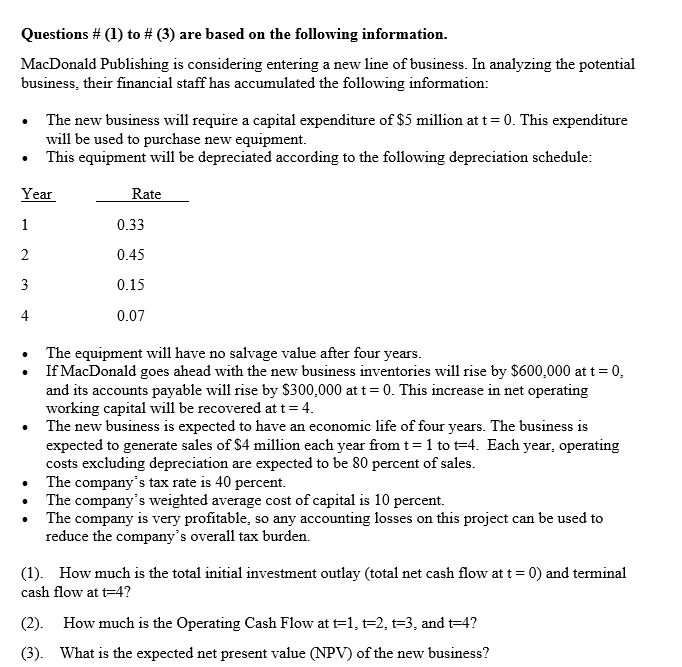

Questions # (1) to # (3) are based on the following information. MacDonald Publishing is considering entering a new line of business. In analyzing the potential business, their financial staff has accumulated the following information: The new business will require a capital expenditure of $5 million at t= 0. This expenditure will be used to purchase new equipment. This equipment will be depreciated according to the following depreciation schedule: Year Rate 1 0.33 2 0.45 3 0.15 4 0.07 . The equipment will have no salvage value after four years. If MacDonald goes ahead with the new business inventories will rise by $600,000 at t=0, and its accounts payable will rise by $300,000 at t= 0. This increase in net operating working capital will be recovered at t=4. The new business is expected to have an economic life of four years. The business is expected to generate sales of $4 million each year from t = 1 to t=4. Each year, operating costs excluding depreciation are expected to be 80 percent of sales. The company's tax rate is 40 percent. The company's weighted average cost of capital is 10 percent. The company is very profitable, so any accounting losses on this project can be used to reduce the company's overall tax burden. (1). How much is the total initial investment outlay (total net cash flow at t=0) and terminal cash flow at t=4? (2). How much is the Operating Cash Flow at t=1, t=2, t=3, and t=4? (3). What is the expected net present value (NPV) of the new business? Questions # (1) to # (3) are based on the following information. MacDonald Publishing is considering entering a new line of business. In analyzing the potential business, their financial staff has accumulated the following information: The new business will require a capital expenditure of $5 million at t= 0. This expenditure will be used to purchase new equipment. This equipment will be depreciated according to the following depreciation schedule: Year Rate 1 0.33 2 0.45 3 0.15 4 0.07 . The equipment will have no salvage value after four years. If MacDonald goes ahead with the new business inventories will rise by $600,000 at t=0, and its accounts payable will rise by $300,000 at t= 0. This increase in net operating working capital will be recovered at t=4. The new business is expected to have an economic life of four years. The business is expected to generate sales of $4 million each year from t = 1 to t=4. Each year, operating costs excluding depreciation are expected to be 80 percent of sales. The company's tax rate is 40 percent. The company's weighted average cost of capital is 10 percent. The company is very profitable, so any accounting losses on this project can be used to reduce the company's overall tax burden. (1). How much is the total initial investment outlay (total net cash flow at t=0) and terminal cash flow at t=4? (2). How much is the Operating Cash Flow at t=1, t=2, t=3, and t=4? (3). What is the expected net present value (NPV) of the new business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts