Question: Please show your working and the formula ------- Question 1 Calculate each machines payback period and state which alternative should be accepted based on this

Please show your working and the formula

-------

Question 1

Calculate each machines payback period and state which alternative should be accepted based on this criterion.

Calculate each machine's internal rate of return (IRR), and using a hurdle rate of 22% state which of the alternatives is acceptable by this criterion.

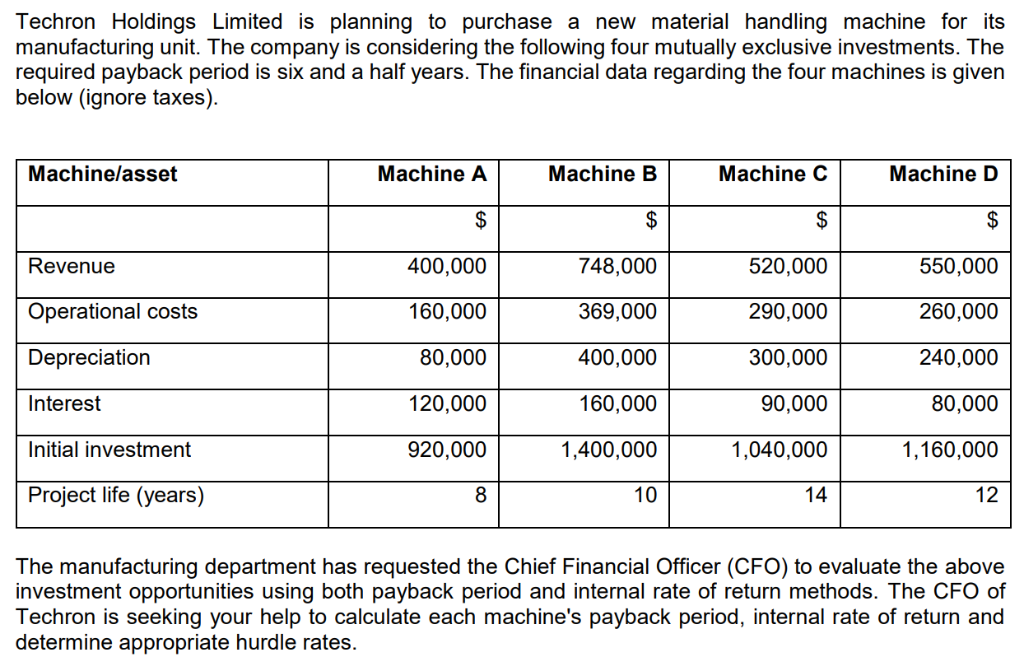

Techron Holdings Limited is planning to purchase a new material handling machine for its manufacturing unit. The company is considering the following four mutually exclusive investments. The required payback period is six and a half years. The financial data regarding the four machines is given below (ignore taxes). Machine/asset Machine A Machine B Machine C Machine D Revenue 400,000 748,000 520,000 550,000 Operational costs 160,000 290,000 369,000 400,000 260,000 240,000 Depreciation 80,000 300,000 Interest 120,000 160,000 90,000 80,000 Initial investment 920,000 1,400,000 1,040,000 1,160,000 Project life (years) 10 12 The manufacturing department has requested the Chief Financial Officer (CFO) to evaluate the above investment opportunities using both payback period and internal rate of return methods. The CFO of Techron is seeking your help to calculate each machine's payback period, internal rate of return and determine appropriate hurdle rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts