Question: please show your works and calculate. Also, mark every point on a diagram. 3-10 3. Suppose that you make an investment on a portfolio consisting

please show your works and calculate. Also, mark every point on a diagram.

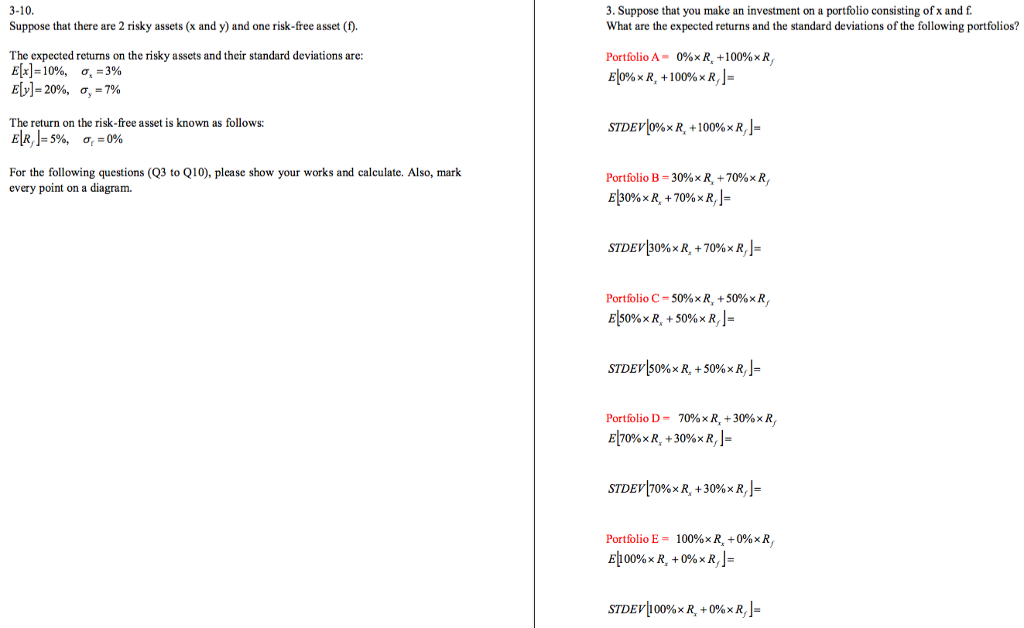

3-10 3. Suppose that you make an investment on a portfolio consisting of x and f. What are the expected returns and the standard deviations of the following portfolios? Suppose that there are 2 risky assets (x and y) and one risk-free asset (f). The expected returns on the risky assets and their standard deviations are: EDI=20%, .-7% The return on the risk-free asset is known as follows: Portfolio A- 0%R.+100%R For the following questions (Q3 to Q10), please show your works and calculate. Also, mark every point on a diagram. Portfolio B-30% x R+ 70% x R ' STDEV 30% R, + 70% R, Portfolio C-50% x R. + 50% R STDEVI5096x R, + 50% x RJ- Portfolio D- 70% R1 + 3096x Rf STDEV!70% R" + 3096x R, Portfolio E = 100%R,+0%xR, 3-10 3. Suppose that you make an investment on a portfolio consisting of x and f. What are the expected returns and the standard deviations of the following portfolios? Suppose that there are 2 risky assets (x and y) and one risk-free asset (f). The expected returns on the risky assets and their standard deviations are: EDI=20%, .-7% The return on the risk-free asset is known as follows: Portfolio A- 0%R.+100%R For the following questions (Q3 to Q10), please show your works and calculate. Also, mark every point on a diagram. Portfolio B-30% x R+ 70% x R ' STDEV 30% R, + 70% R, Portfolio C-50% x R. + 50% R STDEVI5096x R, + 50% x RJ- Portfolio D- 70% R1 + 3096x Rf STDEV!70% R" + 3096x R, Portfolio E = 100%R,+0%xR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts