Question: please show/explain how to create this in excel. Standard Food Company plans to establish a new production line for producing ice creams. The equipment costs

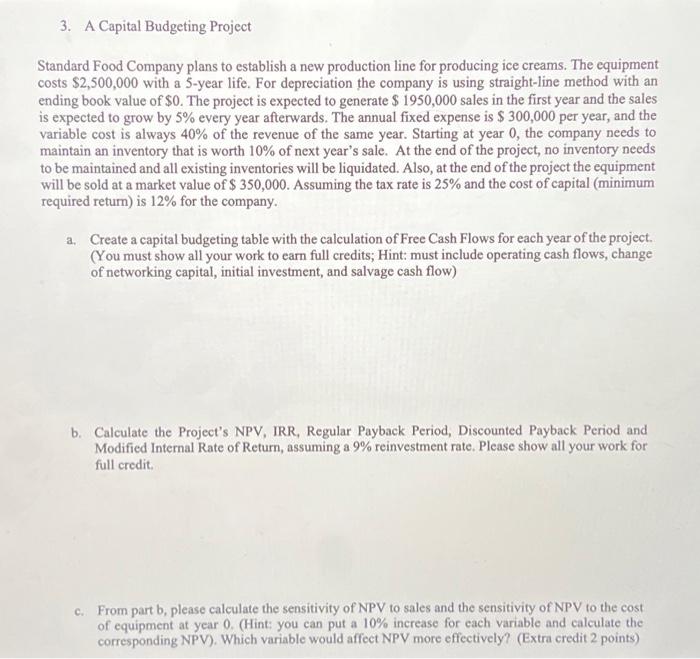

Standard Food Company plans to establish a new production line for producing ice creams. The equipment costs \\( \\$ 2,500,000 \\) with a 5-year life. For depreciation the company is using straight-line method with an ending book value of \\( \\$ 0 \\). The project is expected to generate \\( \\$ 1950,000 \\) sales in the first year and the sales is expected to grow by \5 every year afterwards. The annual fixed expense is \\( \\$ 300,000 \\) per year, and the variable cost is always \40 of the revenue of the same year. Starting at year 0 , the company needs to maintain an inventory that is worth \10 of next year's sale. At the end of the project, no inventory needs to be maintained and all existing inventories will be liquidated. Also, at the end of the project the equipment will be sold at a market value of \\( \\$ 350,000 \\). Assuming the tax rate is \25 and the cost of capital (minimum required return) is \12 for the company. a. Create a capital budgeting table with the calculation of Free Cash Flows for each year of the project. (You must show all your work to earn full credits; Hint: must include operating cash flows, change of networking capital, initial investment, and salvage cash flow) b. Calculate the Project's NPV, IRR, Regular Payback Period, Discounted Payback Period and Modified Internal Rate of Return, assuming a 9\\% reinvestment rate. Please show all your work for full credit. c. From part b, please calculate the sensitivity of NPV to sales and the sensitivity of NPV to the cost of equipment at year 0 . (Hint: you can put a 10\\% increase for each variable and calculate the corresponding NPV). Which variable would affect NPV more effectively? (Extra credit 2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts