Question: please show/explain work so I can check my work and make sure I followed the correct processes. Thank you! Gitano Products operates a job-order costing

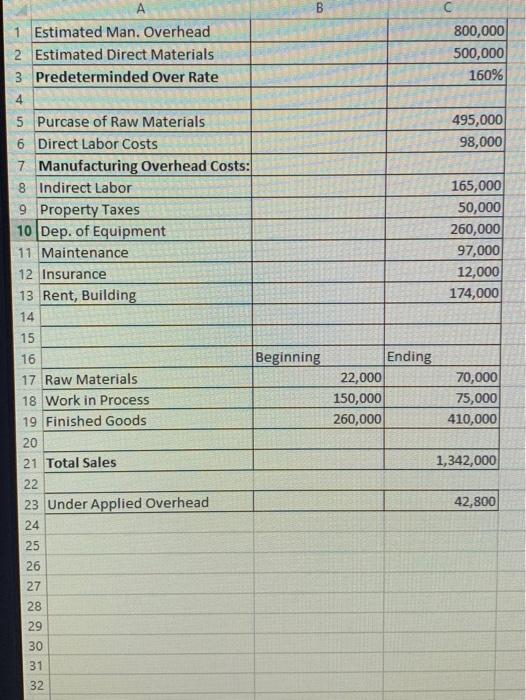

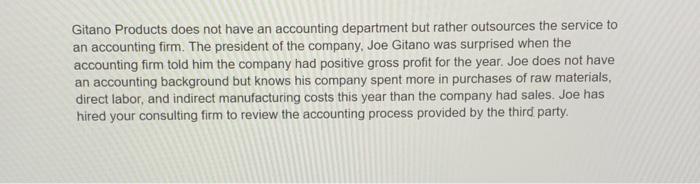

Gitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). Its predetermined overhead rate was based on a cost formula that estimated $800,000 of manufacturing overhead for an estimated allocation base of $500,000 direct material dollars to be used in production. The company has provided the following data for the year ended December 31, 2020: A B 1 Estimated Man. Overhead 800,000 2 Estimated Direct Materials 500,000 3 Predeterminded Over Rate 160% 4 5 Purcase of Raw Materials 495,000 6 Direct Labor Costs 98,000 7 Manufacturing Overhead Costs: 8 Indirect Labor 165,000 9 Property Taxes 50,000 10 Dep. of Equipment 260,000 11 Maintenance 97,000 12 Insurance 12,000 13 Rent, Building 174,000 14 15 16 Beginning Ending 17 Raw Materials 22,000 70,000 18 Work in Process 150,000 75,000 19 Finished Goods 260,000 410,000 20 21 Total Sales 1,342,000 22 23 Under Applied Overhead 42,800 24 25 26 27 28 29 30 31 32 3 Gitano Products does not have an accounting department but rather outsources the service to an accounting firm. The president of the company, Joe Gitano was surprised when the accounting firm told him the company had positive gross profit for the year. Joe does not have an accounting background but knows his company spent more in purchases of raw materials, direct labor, and indirect manufacturing costs this year than the company had sales. Joe has hired your consulting firm to review the accounting process provided by the third party. I 3. Explain how a material over/under applied overhead could negatively impact the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts