Question: Please showing the solution in steps MGT 5 - MANAGERIAL ACCOUNTING PROBLEM 8 GIVEN: VC/UNIT 66 VC % 75.00% FC 396,000 TAX RATE 30% AFTER-TAX

Please showing the solution in steps

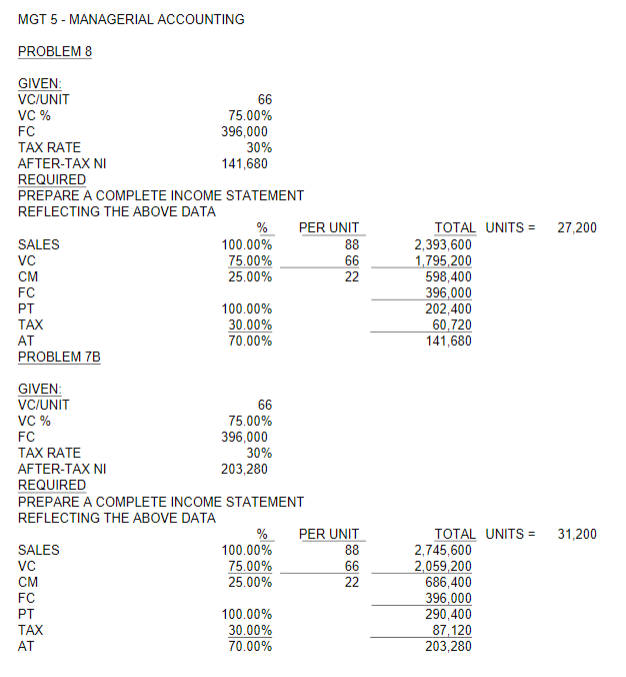

MGT 5 - MANAGERIAL ACCOUNTING PROBLEM 8 GIVEN: VC/UNIT 66 VC % 75.00% FC 396,000 TAX RATE 30% AFTER-TAX NI 141,680 REQUIRED PREPARE A COMPLETE INCOME STATEMENT REFLECTING THE ABOVE DATA % PER UNIT SALES 100.00% VC 75.00% CM 25.00% FC 100.00% TAX 30.00% AT 70.00% PROBLEM 7B 27,200 TOTAL UNITS = 2,393,600 1,795,200 598,400 396,000 202,400 60,720 141,680 PT GIVEN VC/UNIT 66 VC % 75.00% FC 396,000 TAX RATE 30% AFTER-TAX NI 203,280 REQUIRED PREPARE A COMPLETE INCOME STATEMENT REFLECTING THE ABOVE DATA % PER UNIT SALES 100.00% VC 75.00% CM 25.00% FC PT 100.00% TAX 30.00% 70.00% 31,200 TOTAL UNITS = 2,745,600 2,059,200 686,400 396,000 290,400 87,120 203,280 AT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts