Question: please shownall formulas and all work required to find each answer. do not out into excel Citibank recently issued a 6 -month deposit to IBM

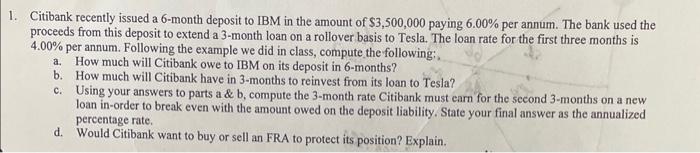

Citibank recently issued a 6 -month deposit to IBM in the amount of $3,500,000 paying 6.00% per annum. The bank used the proceeds from this deposit to extend a 3-month loan on a rollover basis to Tesla. The loan rate for the first three months is 4.00% per annum. Following the example we did in class, compute the following;, a. How much will Citibank owe to IBM on its deposit in 6-months? b. How much will Citibank have in 3-months to reinvest from its loan to Tesla? c. Using your answers to parts a \& b, compute the 3-month rate Citibank must earn for the second 3-months on a new loan in-order to break even with the amount owed on the deposit liability. State your final answer as the annualized percentage rate. d. Would Citibank want to buy or sell an FRA to protect its position? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts