Question: Please shows function input in the financial calculator to solve this problem 10 Henry is assessing his retirement strategy, as he plans to retire 10

Please shows function input in the financial calculator to solve this problem

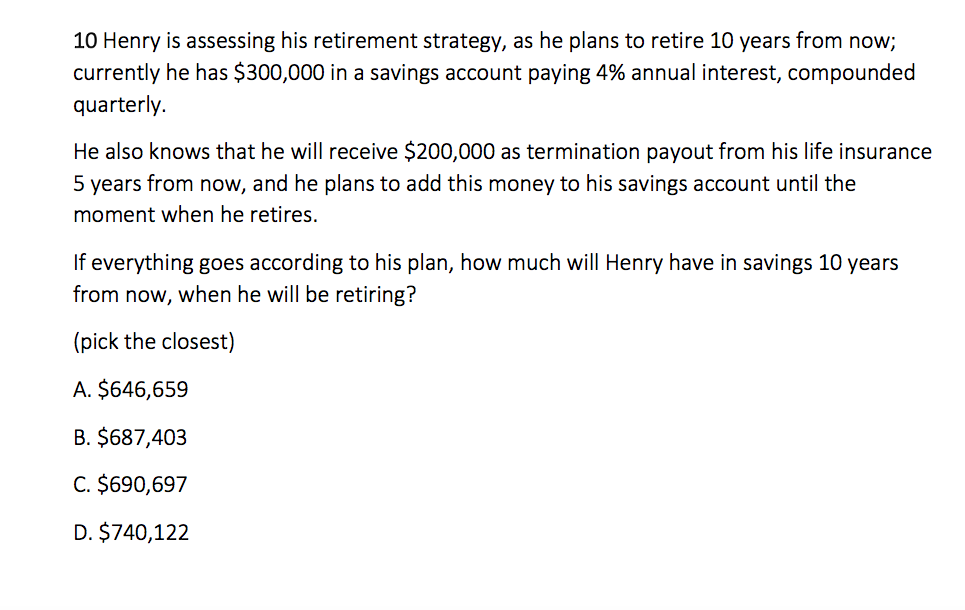

10 Henry is assessing his retirement strategy, as he plans to retire 10 years from now; currently he has $300,000 in a savings account paying 4% annual interest, compounded quarterly. He also knows that he will receive $200,000 as termination payout from his life insurance 5 years from now, and he plans to add this money to his savings account until the moment when he retires. If everything goes according to his plan, how much will Henry have in savings 10 years from now, when he will be retiring? (pick the closest) A. $646,659 B. $687,403 C. $690,697 D. $740,122

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts