Question: Please sir the quotations must be answered perfectly TUTORIAL CHAPTER 3: RATIO ANALYSIS The following are the financial statements of Kacang Jew Manufacturing for the

Please sir the quotations must be answered perfectly

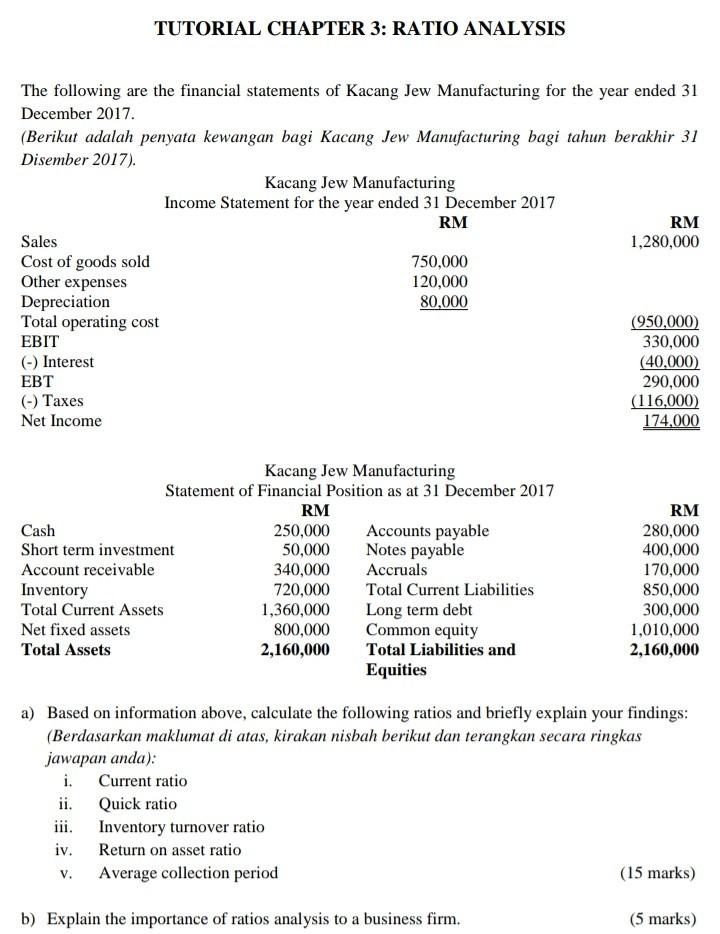

TUTORIAL CHAPTER 3: RATIO ANALYSIS The following are the financial statements of Kacang Jew Manufacturing for the year ended 31 December 2017. (Berikut adalah penyata kewangan bagi Kacang Jew Manufacturing bagi tahun berakhir 31 Disember 2017). Kacang Jew Manufacturing Income Statement for the year ended 31 December 2017 RM RM Sales 1,280,000 Cost of goods sold 750,000 Other expenses 120,000 Depreciation 80,000 Total operating cost (950,000) EBIT 330,000 (-) Interest (40,000) EBT 290,000 (-) Taxes (116,000) Net Income 174,000 Kacang Jew Manufacturing Statement of Financial Position as at 31 December 2017 RM Cash 250,000 Accounts payable Short term investment 50,000 Notes payable Account receivable 340,000 Accruals Inventory 720,000 Total Current Liabilities Total Current Assets 1,360,000 Long term debt Net fixed assets 800,000 Common equity Total Assets 2,160,000 Total Liabilities and Equities RM 280,000 400,000 170,000 850,000 300,000 1,010,000 2,160,000 a) Based on information above, calculate the following ratios and briefly explain your findings: (Berdasarkan maklumat di atas, kirakan nisbah berikut dan terangkan secara ringkas jawapan anda): i. Current ratio ii. Quick ratio Inventory turnover ratio iv. Return on asset ratio v. Average collection period (15 marks) b) Explain the importance of ratios analysis to a business firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts