Question: please slove and explain how answer was obtained CAPITAL STRUCTURE PROBLEM The following data condition firm's current financial reflect a Value of debt (book value=narket

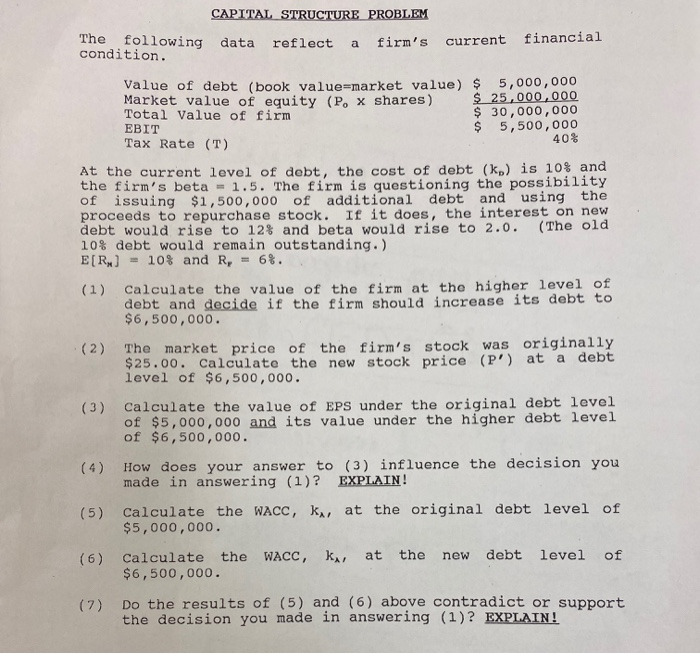

CAPITAL STRUCTURE PROBLEM The following data condition firm's current financial reflect a Value of debt (book value=narket value) $5,000 , 000 $ 25,000,000 $ 30,000,000 $ 5,500,000 40% Market value of equity (Po x shares) Total Value of firm BIT Tax Rate (T) At the current level off debt, the cost of debt (k,) is 10% and the firm's beta 1.5. The firm is questioning the possibility of issuing $1,500,000 of additional debt proceeds to repurchase stock. If it does, the interest on new debt would rise to 12% and beta would rise to 2.0 10% debt would remain outstanding.) E[R]108 and R, 68. and using the (The old (1) Calculate the value of the firm at the higher level of debt and decide if the firm should increase its debt to $6,500,000. (2) The market price of the firm's stock was originally $25.00. Calculate the new stock price (P') at a debt level of $6,500 , 000 . (3) Calculate the value of EPS under the original debt level of $5,000,000 and its value under the higher debt level of $6,500,000. (4) How does your answer to (3) influence the decision you made in answering (1)? EXPLAIN! (5) calculate the WACC, k, at the original debt level of $5,000,000. (6) Calculate the WACC, k, at the new debt level of $6,500,000. Do the results of (5) and (6) above contradict or support the decision you made in answering (1)? EXPLAIN! (7)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts