Question: please slove both 1 and 2 1. Consider the probability distributions of the first year cash flows of two projects, MNO and PQR: MNO POR

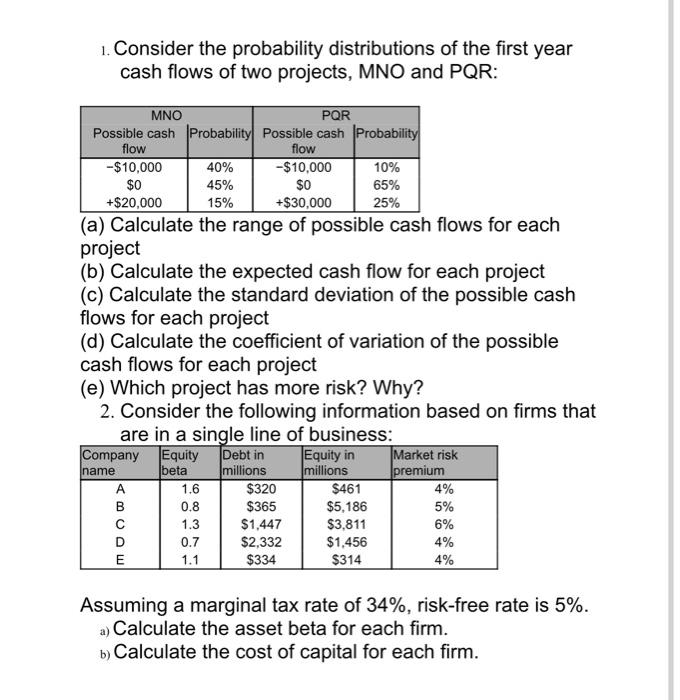

1. Consider the probability distributions of the first year cash flows of two projects, MNO and PQR: MNO POR Possible cash Probability Possible cash Probability flow flow -$10,000 40% -$10,000 10% $0 45% $0 65% +$20,000 15% +$30,000 25% (a) Calculate the range of possible cash flows for each project (b) Calculate the expected cash flow for each project (c) Calculate the standard deviation of the possible cash flows for each project (d) Calculate the coefficient of variation of the possible cash flows for each project (e) Which project has more risk? Why? 2. Consider the following information based on firms that are in a single line of business: Company Equity Debt in Equity in Market risk name millions millions premium 1.6 $320 $461 4% 0.8 $365 $5,186 5% $1,447 $3,811 6% D 0.7 $2,332 $1,456 4% E 1.1 $334 $314 beta A B 1.3 4% Assuming a marginal tax rate of 34%, risk-free rate is 5%. a) Calculate the asset beta for each firm. b) Calculate the cost of capital for each firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts