Question: please solve 13,14 please it's a request step by step please i will give you a thumbs up please do it please... Question 13 Prepare

please solve 13,14 please it's a request step by step please i will give you a thumbs up please do it please...

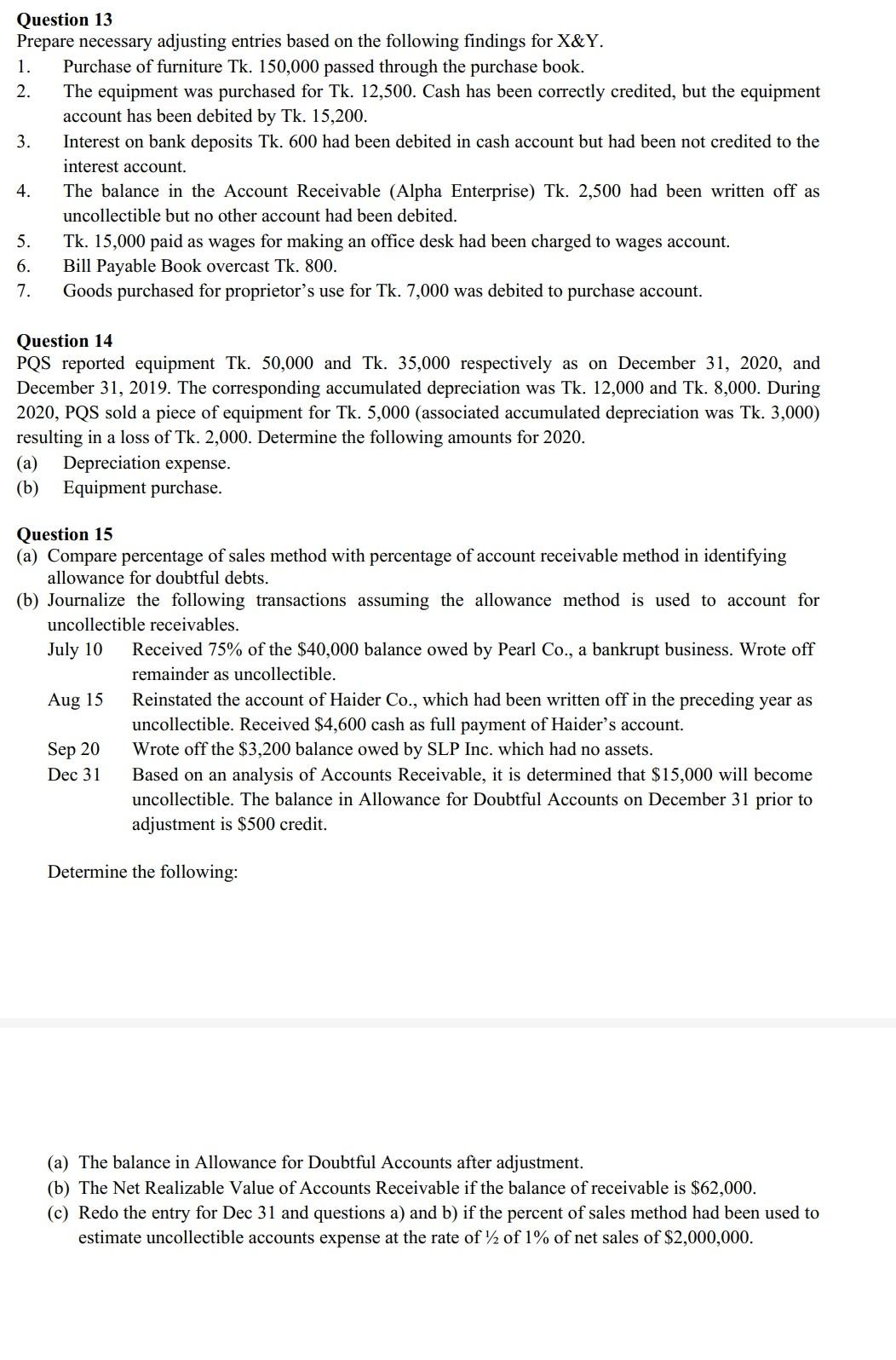

Question 13 Prepare necessary adjusting entries based on the following findings for X&Y. 1. Purchase of furniture Tk. 150,000 passed through the purchase book. 2. The equipment was purchased for Tk. 12,500. Cash has been correctly credited, but the equipment account has been debited by Tk. 15,200. 3. Interest on bank deposits Tk. 600 had been debited in cash account but had been not credited to the interest account. 4. The balance in the Account Receivable (Alpha Enterprise) Tk. 2,500 had been written off as uncollectible but no other account had been debited. 5. Tk. 15,000 paid as wages for making an office desk had been charged to wages account. 6. Bill Payable Book overcast Tk. 800. 7. Goods purchased for proprietor's use for Tk. 7,000 was debited to purchase account. Question 14 PQS reported equipment Tk. 50,000 and Tk. 35,000 respectively as on December 31, 2020, and December 31, 2019. The corresponding accumulated depreciation was Tk. 12,000 and Tk. 8,000. During 2020, PQS sold a piece of equipment for Tk. 5,000 (associated accumulated depreciation was Tk. 3,000) resulting in a loss of Tk. 2,000. Determine the following amounts for 2020. (a) Depreciation expense. (b) Equipment purchase. July 10 Question 15 (a) Compare percentage of sales method with percentage of account receivable method in identifying allowance for doubtful debts. (b) Journalize the following transactions assuming the allowance method is used to account for uncollectible receivables. Received 75% of the $40,000 balance owed by Pearl Co., a bankrupt business. Wrote off remainder as uncollectible. Reinstated the account of Haider Co., which had been written off in the preceding year as uncollectible. Received $4,600 cash as full payment of Haider's account. Wrote off the $3,200 balance owed by SLP Inc. which had no assets. Dec 31 Based on an analysis of Accounts Receivable, it is determined that $15,000 will become uncollectible. The balance in Allowance for Doubtful Accounts on December 31 prior to adjustment is $500 credit. Aug 15 Sep 20 Determine the following: (a) The balance in Allowance for Doubtful Accounts after adjustment. (b) The Net Realizable Value of Accounts Receivable if the balance of receivable is $62,000. (c) Redo the entry for Dec 31 and questions a) and b) if the percent of sales method had been used to estimate uncollectible accounts expense at the rate of 2 of 1% of net sales of $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts