Question: please solve 1-3.4 by showing work/formulas in excel too. Thank you so much, your help is great appreciated. will upvote. The repricing model of measuring

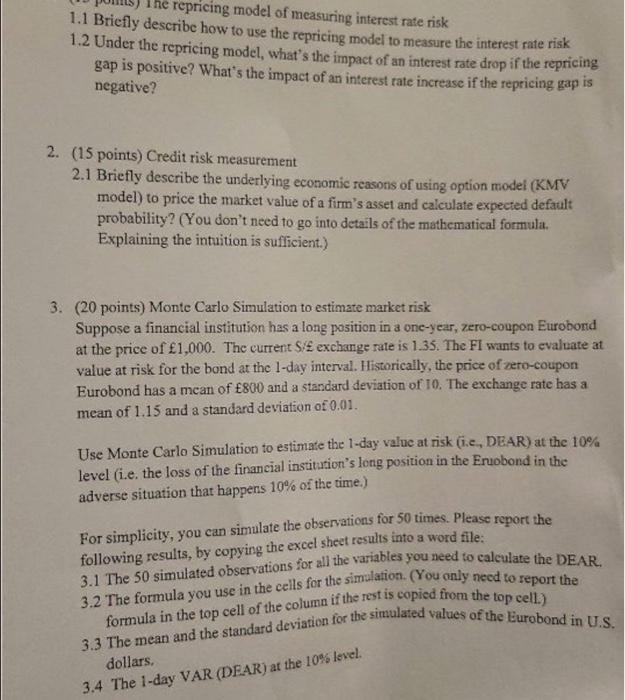

The repricing model of measuring interest rate risk 1.1 Briefly describe how to use the repricing model to measure the interest rate risk 1.2 Under the repricing model, what's the impact of an interest rate drop if the repricing gap is positive? What's the impact of an interest rate increase if the repricing gap is negative? 2. (15 points) Credit risk measurement 2.1 Briefly describe the underlying economic reasons of using option model (KMV model) to price the market value of a firm's asset and calculate expected default probability? (You don't need to go into details of the mathematical formula Explaining the intuition is sufficient.) 3. (20 points) Monte Carlo Simulation to estimate market risk Suppose a financial institution has a long position in a one-year, zero-coupon Eurobond at the price of 1,000. The current S exchange rate is 1.35. The FI wants to evaluate at value at risk for the band at the 1-day interval. Historically, the price of zero-coupon Eurobond has a mean of 800 and a standard deviation of 10. The exchange rate has a mean of 1.15 and a standard deviation of 0.01. a Use Monte Carlo Simulation to estimate the 1-day value at risk (.e., DEAR) at the 10% level (i.e. the loss of the financial institution's long position in the Eruobond in the adverse situation that happens 10% of the time.) For simplicity, you can simulate the observations for 50 times. Please report the following results, by copying the excel sheet results into a word file: 3.1 The 50 simulated observations for all the variables you need to calculate the DEAR. 3.2 The formula you use in the cells for the simulation. (You only need to report the formula in the top cell of the column if the rest is copied from the top cell.) 3.3 The mean and the standard deviation for the simulated values of the Eurobond in U.S. dollars, 3.4 The 1-day VAR (DEAR) at the 10% level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts