Question: Please solve 1-4 using excel. Show all formulas please. Thank you Questions 1-4 Two-Stocks Portfolio Suppose we want to construct a portfolio that consists of

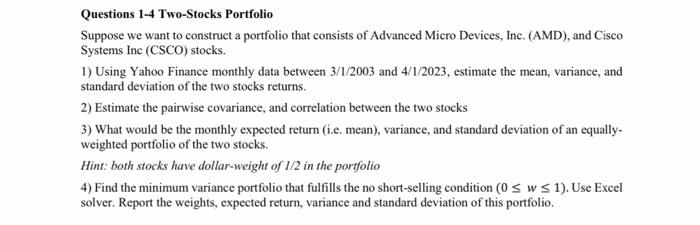

Questions 1-4 Two-Stocks Portfolio Suppose we want to construct a portfolio that consists of Advanced Micro Devices, Inc. (AMD), and Cisco Systems Inc (CSCO) stocks. 1) Using Yahoo Finance monthly data between 3/1/2003 and 4/1/2023, estimate the mean, variance, and standard deviation of the two stocks returns. 2) Estimate the pairwise covariance, and correlation between the two stocks 3) What would be the monthly expected return (i.e. mean), variance, and standard deviation of an equallyweighted portfolio of the two stocks. Hint: both stocks have dollar-weight of 1/2 in the portfolio 4) Find the minimum variance portfolio that fulfills the no short-selling condition ( 0w1). Use Excel solver. Report the weights, expected return, variance and standard deviation of this portfolio. Questions 1-4 Two-Stocks Portfolio Suppose we want to construct a portfolio that consists of Advanced Micro Devices, Inc. (AMD), and Cisco Systems Inc (CSCO) stocks. 1) Using Yahoo Finance monthly data between 3/1/2003 and 4/1/2023, estimate the mean, variance, and standard deviation of the two stocks returns. 2) Estimate the pairwise covariance, and correlation between the two stocks 3) What would be the monthly expected return (i.e. mean), variance, and standard deviation of an equallyweighted portfolio of the two stocks. Hint: both stocks have dollar-weight of 1/2 in the portfolio 4) Find the minimum variance portfolio that fulfills the no short-selling condition ( 0w1). Use Excel solver. Report the weights, expected return, variance and standard deviation of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts