Question: Please solve 1-7 under the Harods sporting goods required calculations Harrod's Sporting Goods Jim Harrod lenew that service, above all, Nebraska), took great pride in

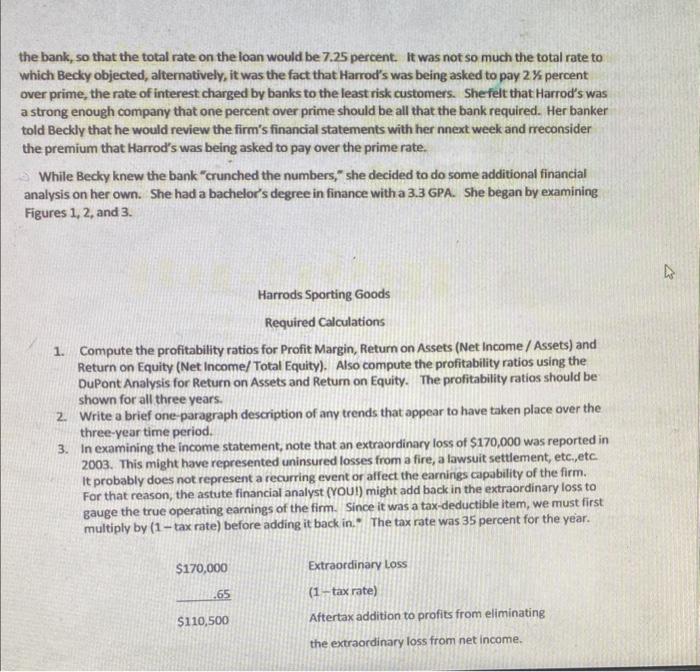

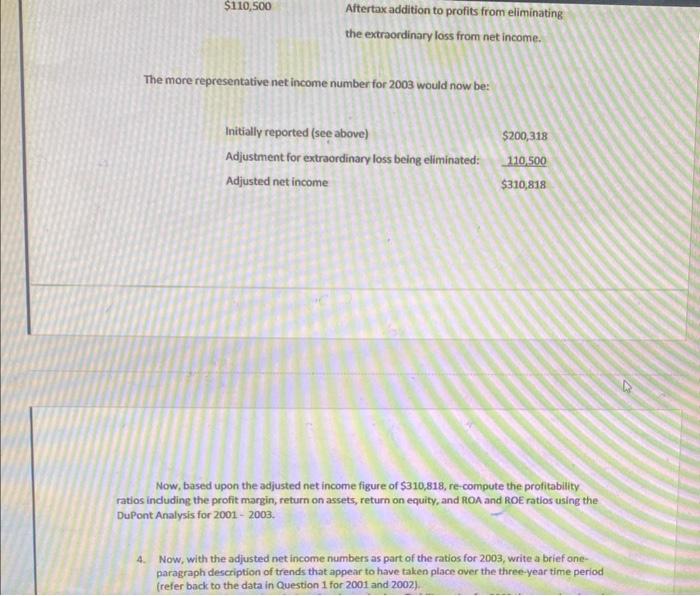

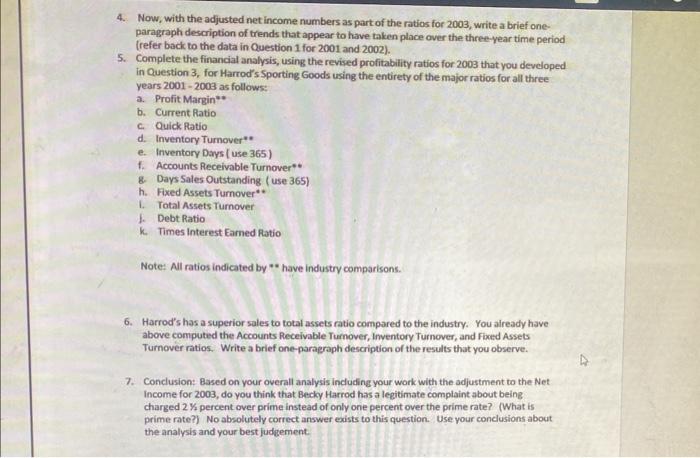

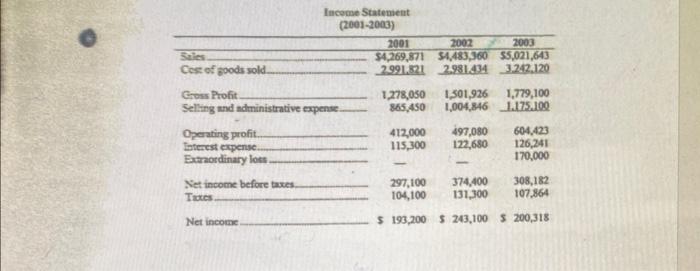

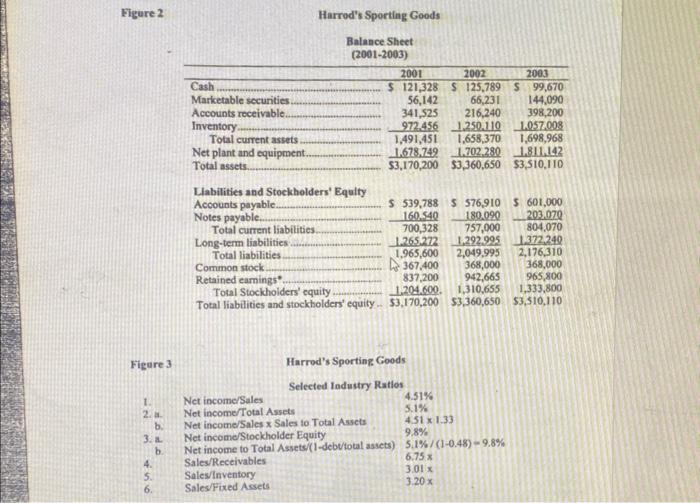

Harrod's Sporting Goods Jim Harrod lenew that service, above all, Nebraska), took great pride in his stores as was important to his customers. Jim and well as his prior university affliation. He Becky Harrod had opened their first store in Omahs, Nebraslat in 1991. Harrod's camied and Becky (also a University of Nebrasica a full line of sporting goods including graduate in the mid-1980s) contributed everything from beseball bats and uniforms $2,000 annually to the University of to fishing gear and hunting equipment. By Nebraska athletic program. the year 2004, there were swelve Farmol The growth in the stores was the good rtores producing $5 miltion in total sales and news for Jim and Becly. The less than good generating a profit of over 5200,000 per news was the intense competition that they year. faced. Not only were they forced to cormpete On the positive side, there was an with nationally established sporting good increasing demand for sporting goods as stores such as Oshrman's and the Academy, leisure time activities continued to grow. but Wal-Mart and Lowe's also represcuted Also, the state of Nabraks, where all twelve intense competition for the sporuing goods stores were located, was experiencing dollar. If appeared that every time Wal-Mart moderate growth. Finally, there had been a opened a new store near one of its locations, sharp upturn in the last decade for women's Lowe's put up one of its "big-boxes" nearby. sporting goods equipment. This was The national stores were extremely particularly true of softball tmiforms for competitive in terms of pricing. However, high school, college, and city league Jim, Becky and their employees offered women's teams. Jim's wife Becky was one great personal service, and they hoped this of the top softball players in the city of would ailow them to continue with their Omaha and her extensive contacts specialty niche. throughout the state help to bring in new In January of 2004, Becky, who served business. While Nebraska is primanly as the company's chief financial officer, known as a football state, Omaha actually walked into Jim's office and said, "T've had it hosts the college baseball world serried each with the First Natianal Bank of Omaha. It is year in June and this generates a lot of willing to renew our loan and line of credit, interest in baseball (and softball as well). but the bank wants to charge us 21/2 Jim, who had been a walk-on third string pereentage points over prime. The prime offensive tackle at the University of rate is the rate at which banks make losns to Nebraska (the Combuskers in Lincoln, their most creditworthy customers. It was 4.75 percent at the time Becky had visited the bank, so that the total rate on the loan would be 7.25 percent. It was not so much the total rate to which Becky objected, alternatively, it was the fact that Harrod's was being asked to pay 2% percent over prime, the rate of interest charged by banks to the least risk customers. She felt that Harrod's was a strong enough company that one percent over prime should be all that the bank required. Her banker told Beckly that he would review the firm's financial statements with her nnext week and rreconsider the premium that Harrod's was being asked to pay over the prime rate. While Becky knew the bank "crunched the numbers," she decided to do some additional financial analysis on her own. She had a bachelor's degree in finance with a 3.3 GPA. She began by examining Figures 1,2 , and 3. Harrods Sporting Goods Required Calculations 1. Compute the profitability ratios for Profit Margin, Return on Assets (Net income / Assets) and Return on Equity (Net Income/ Total Equity). Also compute the profitability ratios using the DuPont Analysis for Return on Assets and Retum on Equity. The profitability ratios should be shown for all three years. 2. Write a brief one-paragraph description of any trends that appear to have taken place over the three-year time period. 3. In examining the income statement, note that an extraordinary loss of $170,000 was reported in 2003. This might have represented uninsured losses from a fire, a lawsuit settlement, etc.,etc. It probably does not represent a recurring event or affect the earnings capability of the firm. For that reason, the astute financial analyst (YOUI) might add back in the extraordinary loss to gauge the true operating earnings of the firm. Since it was a tax-deductible item, we must first multiply by ( 1 tax rate) before adding it back in.* The tax rate was 35 percent for the year. The more representative net income number for 2003 would now be: Now, based upon the adjusted net income figure of $310,818, re-compute the profitability. ratios including the profit margin, return on assets, return on equity, and ROA and ROE ratios using the DuPont Analysis for 2001 - 2003. 4. Now, with the adjusted net income numbers as part of the ratios for 2003 , write a brief oneparagraph description of trends that appear to have taken place over the three-year time period (refer back to the data in Question 1 for 2001 and 2002). 4. Now, with the adjusted net income numbers as part of the ratios for 2003 , write a brief oneparagraph description of trends that appear to have taken place over the three-year time period (refer back to the data in Question 1 for 2001 and 2002). 5. Complete the financial analysis, using the revised profitability ratios for 2003 that you developed in Question 3, for Harrod's Sporting Goods using the entirety of the major ratios for all three years 2001 - 2008 as follows: a. Profit Margin** b. Current Ratio c. Quick. Ratio d. Inventory Turnover": e. Inventory Days ( use 365) f. Accounts Receivable Turnover** g. Days Sales Outstanding (use 365) h. Fixed Assets Tumover 1. Total Assets Turnover 1. Debt Ratio k. Times Interest Earned Ratio Note: All ratios indicated by *" have industry comparisons. 6. Harrod's has a superior sales to total assets ratio compared to the industry. You aiready have above computed the Accounts Receivable Turnover, Inventory Turnover, and Fixed Assets Turnover ratios. Write a brief one-paragraph description of the results that you observe. 7. Conclusion: Based on your overall analysis induding your work with the adjustment to the Net. Income for 2003, do you think that Becky Harrod has a legitimate complaint about being charged 2% percent over prime instead of only one percent over the prime rate? (What is prime rate?) No absolutely correct answer exists to this question. Use your conclusions about the analysis and your best judgement. Inceme Statencent Harrod's Sporting Goods Balance Sheet Harrod's Sporting Coods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts