Question: please solve 33 Advanced Scenario 8: Richard Roosevelt Directions Using the tax software, complete the tax retum, including Form 1040 and all appropri ate forms,

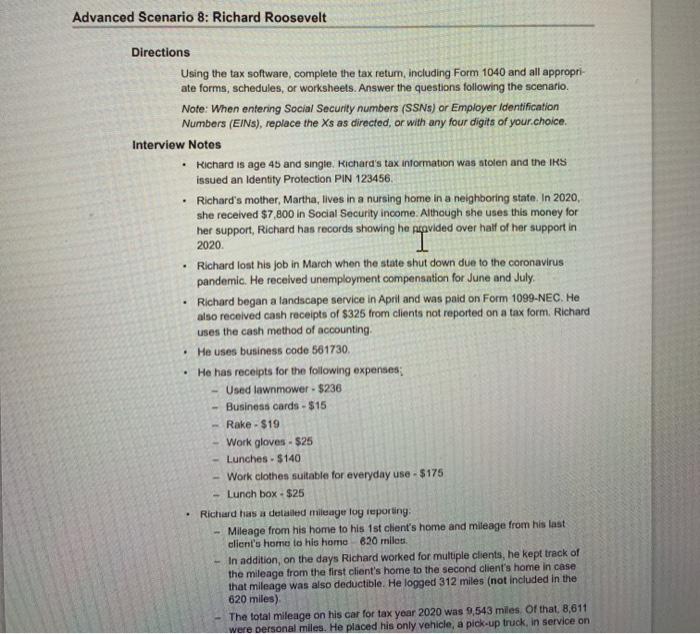

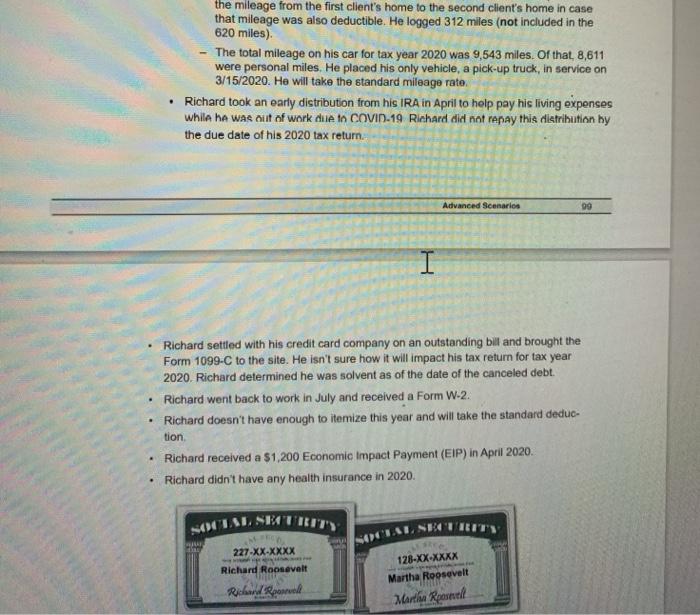

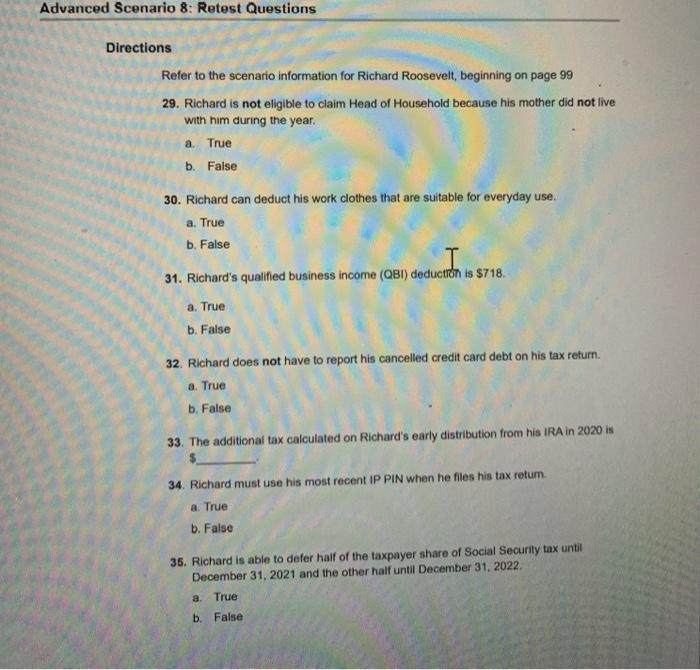

Advanced Scenario 8: Richard Roosevelt Directions Using the tax software, complete the tax retum, including Form 1040 and all appropri ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSN) or Employer Identification Numbers (EIN), replace the Xs as directed, or with any four digits of your choice. Interview Notes Richard is age 45 and single, Richard's tax information was stolen and the IRS issued an Identity Protection PIN 123456 Richard's mother, Martha, lives in a nursing home in a neighboring state. In 2020, she received $7,800 in Social Security income. Although she uses this money for her support, Richard has records showing he provided over half of her support in 2020 Richard lost his job in March when the state shut down due to the coronavirus pandemic. He received unemployment compensation for June and July Richard began a landscape service in April and was paid on Form 1099-NEC. He also received cash receipts of $325 from clients not reported on a tax form. Richard uses the cash method of accounting, He uses business code 561730, He has receipts for the following expenses Used lawnmower - $236 Business cards - $15 Rake - $19 Work gloves - $25 Lunches. $140 Work clothes suitable for everyday use - $175 - Lunch box - $25 Richard has a detailed mileage log reporting Mileage from his home to his 1st client's home and mileage from his last client's home to his home 620 miles In addition, on the days Richard worked for multiple clients, he kept track of the mileage from the first client's home to the second client's home in case that mileage was also deductible. He logged 312 miles (not included in the 620 miles) The total mileage on his car for tax year 2020 was 9,543 miles. Of that, 8,611 were personal miles. He placed his only vehicle, a pick-up truck, in service on SOCIAL SECURITY the mileage from the first client's home to the second client's home in case that mileage was also deductible. He logged 312 miles (not included in the 620 miles) The total mileage on his car for tax year 2020 was 9,543 miles. Of that 8,611 were personal miles. He placed his only vehicle, a pick-up truck, in service on 3/15/2020. He will take the standard mileage rate Richard took an early distribution from his IRA in April to help pay hic living expenses while he was out of work due In COVID-19 Richard did not repay this distribution by the due date of his 2020 tax return Advanced Scenarios 09 I Richard settled with his credit card company on an outstanding bill and brought the Form 1099-C to the site. He isn't sure how it will impact his tax return for tax year 2020. Richard determined he was solvent as of the date of the canceled debt. Richard went back to work in July and received a Form W-2. Richard doesn't have enough to itemize this year and will take the standard deduc- tion Richard received a $1,200 Economic Impact Payment (EIP) in April 2020. Richard didn't have any health insurance in 2020 227-XX-XXXX Richard Roosevelt 128-XX-XXXX Martha Roosevelt Martha Roosen Richard povel Advanced Scenario 8: Retest Questions Directions Refer to the scenario information for Richard Roosevelt, beginning on page 99 29. Richard is not eligible to claim Head of Household because his mother did not live with him during the year. a True b. False 30. Richard can deduct his work clothes that are suitable for everyday use. a. True b. False 31. Richard's qualified business income (QBI) deduction is $718. a. True b. False 32. Richard does not have to report his cancelled credit card debt on his tax return a. True b. False 33. The additional tax calculated on Richard's early distribution from his IRA in 2020 is 34. Richard must use his most recent IP PIN when he files his tax retum a. True b. False 35. Richard is able to defer half of the taxpayer share of Social Security tax until December 31, 2021 and the other half until December 31, 2022. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts