Question: please solve #6 as soon as possible. with or without gaur , Ur T e d). Understanding Rate of Return (ROR) 1. (10 points) Assume

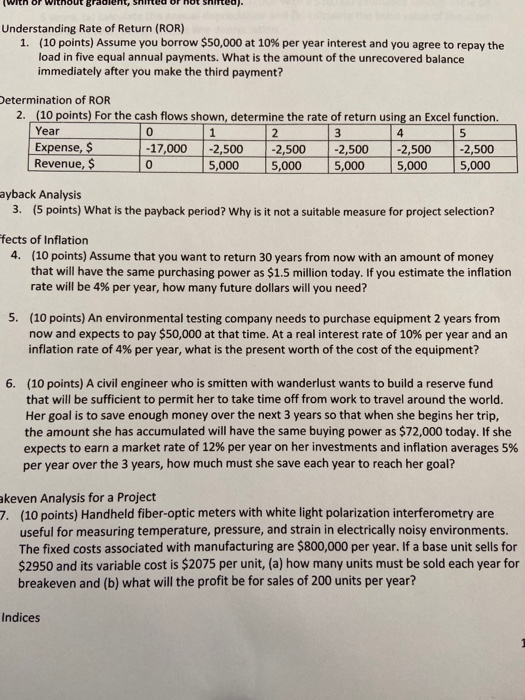

with or without gaur , Ur T e d). Understanding Rate of Return (ROR) 1. (10 points) Assume you borrow $50,000 at 10% per year interest and you agree to repay the load in five equal annual payments. What is the amount of the unrecovered balance immediately after you make the third payment? Determination of ROR 2. (10 points) For the cash flows shown, determine the rate of return using an Excel function. Year 1 2 3 4 5 Expense, $ -17,000 -2,500 -2,500 -2,500 -2,500 -2,500 Revenue, $ o 5,000 5,000 5,000 5,000 5,000 ayback Analysis 3. (5 points) What is the payback period? Why is it not a suitable measure for project selection? fects of Inflation 4. (10 points) Assume that you want to return 30 years from now with an amount of money that will have the same purchasing power as $1.5 million today. If you estimate the inflation rate will be 4% per year, how many future dollars will you need? 5. (10 points) An environmental testing company needs to purchase equipment 2 years from now and expects to pay $50,000 at that time. At a real interest rate of 10% per year and an inflation rate of 4% per year, what is the present worth of the cost of the equipment? 6. (10 points) A civil engineer who is smitten with wanderlust wants to build a reserve fund that will be sufficient to permit her to take time off from work to travel around the world. Her goal is to save enough money over the next 3 years so that when she begins her trip, the amount she has accumulated will have the same buying power as $72,000 today. If she expects to earn a market rate of 12% per year on her investments and inflation averages 5% per year over the 3 years, how much must she save each year to reach her goal? akeven Analysis for a Project 7. (10 points) Handheld fiber-optic meters with white light polarization interferometry are useful for measuring temperature, pressure, and strain in electrically noisy environments. The fixed costs associated with manufacturing are $800,000 per year. If a base unit sells for $2950 and its variable cost is $2075 per unit, (a) how many units must be sold each year for breakeven and (b) what will the profit be for sales of 200 units per year? Indices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts