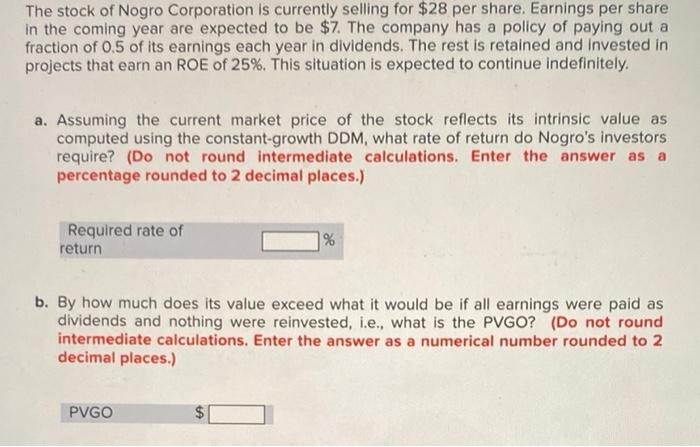

Question: please solve a and b a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what

a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Nogro's investors require? (Do not round intermediate calculations. Enter the answer as a percentage rounded to 2 decimal places.) Required rate of return b. By how much does its value exceed what it would be if all earnings were paid as dividends and nothing were reinvested, i.e., what is the PVGO? (Do not round intermediate calculations. Enter the answer as a numerical number rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts