Question: Please solve A, B, and C. Please show work. Plaxo Inc. intends to issue $50 million in capital to fund new opportunities. If the firm

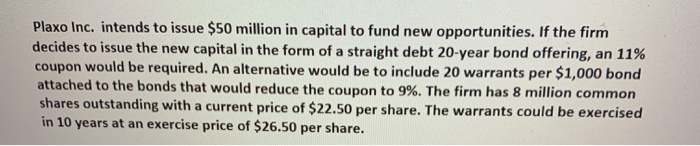

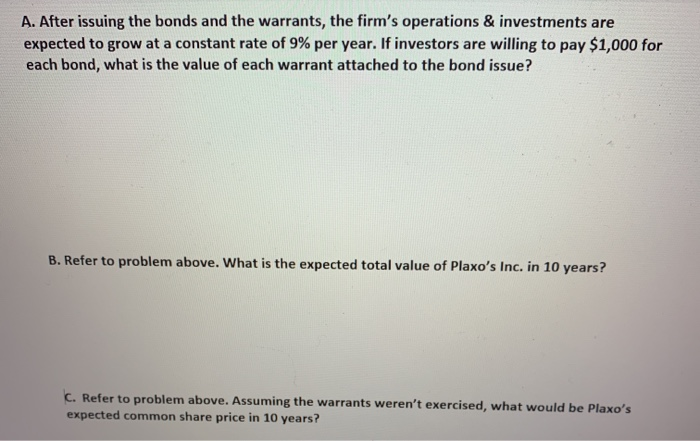

Plaxo Inc. intends to issue $50 million in capital to fund new opportunities. If the firm decides to issue the new capital in the form of a straight debt 20-year bond offering, an 11% coupon would be required. An alternative would be to include 20 warrants per $1,000 bond attached to the bonds that would reduce the coupon to 9%. The firm has 8 million common shares outstanding with a current price of $22.50 per share. The warrants could be exercised in 10 years at an exercise price of $26.50 per share. A. After issuing the bonds and the warrants, the firm's operations & investments are expected to grow at a constant rate of 9% per year. If investors are willing to pay $1,000 for each bond, what is the value of each warrant attached to the bond issue? B. Refer to problem above. What is the expected total value of Plaxo's Inc. in 10 years? C. Refer to problem above. Assuming the warrants weren't exercised, what would be Plaxo's expected common share price in 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts