Question: Please solve A, B, and C. Please show work. Thank you. LO. You are the CFO of Jenware, Inc., a wholesale distributor of kitchen appliances.

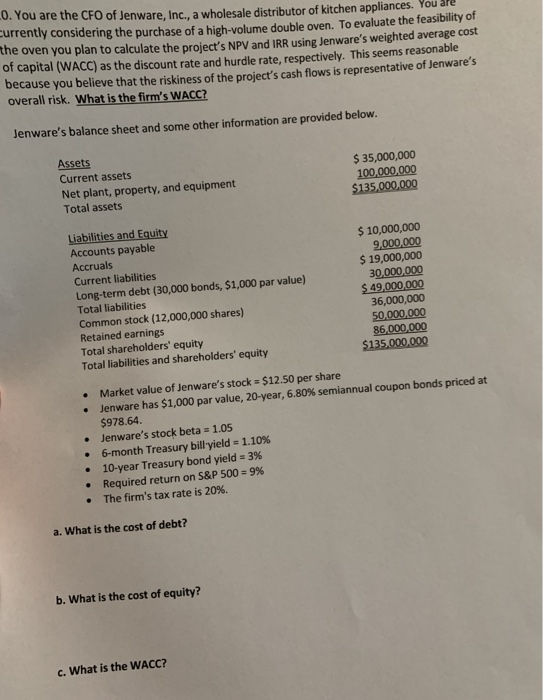

LO. You are the CFO of Jenware, Inc., a wholesale distributor of kitchen appliances. You Currently considering the purchase of a high-volume double oven. To evaluate the feasibility of the oven you plan to calculate the project's NPV and IRR using Jenware's weighted average cost of capital (WACC) as the discount rate and hurdle rate, respectively. This seems reasonable because you believe that the riskiness of the project's cash flows is representative of Jenware's overall risk. What is the firm's WACC? Jenware's balance sheet and some other information are provided below. Assets Current assets Net plant, property, and equipment Total assets $ 35,000,000 100,000,000 $135,000,000 Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (30,000 bonds, $1,000 par value) Total liabilities Common stock (12,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 10,000,000 9,000,000 $ 19,000,000 30,000,000 $ 49,000,000 36,000,000 50,000,000 86.000.000 $135.000.000 . Market value of Jenware's stock = $12.50 per share Jenware has $1,000 par value, 20-year, 6.80% semiannual coupon bonds priced at $978.64. Jenware's stock beta = 1.05 6-month Treasury bill yield = 1.10% 10-year Treasury bond yield = 3% Required return on S&P 500 = 9% The firm's tax rate is 20%. . . a. What is the cost of debt? b. What is the cost of equity? c. What is the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts