Question: Please Solve A - D 6.2. ARM. Suppose that you are considering an ARM with the following characteristics: Mortgage Amount =$120,000 Index = One-year TB

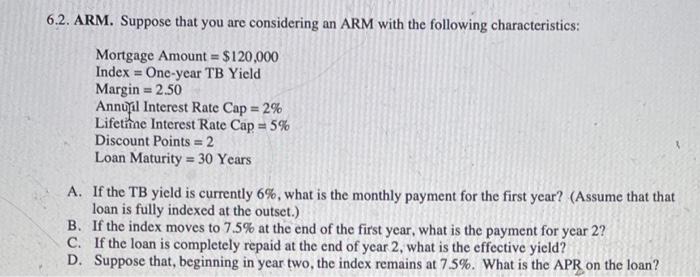

6.2. ARM. Suppose that you are considering an ARM with the following characteristics: Mortgage Amount =$120,000 Index = One-year TB Yield Margin =2.50 Annil Interest Rate Cap =2% Lifetinne Interest Rate Cap =5% Discount Points =2 Loan Maturity =30 Years A. If the TB yield is currently 6%, what is the monthly payment for the first year? (Assume that that loan is fully indexed at the outset.) B. If the index moves to 7.5% at the end of the first year, what is the payment for year 2 ? C. If the loan is completely repaid at the end of year 2 , what is the effective yield? D. Suppose that, beginning in year two, the index remains at 7.5%. What is the APR on the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts